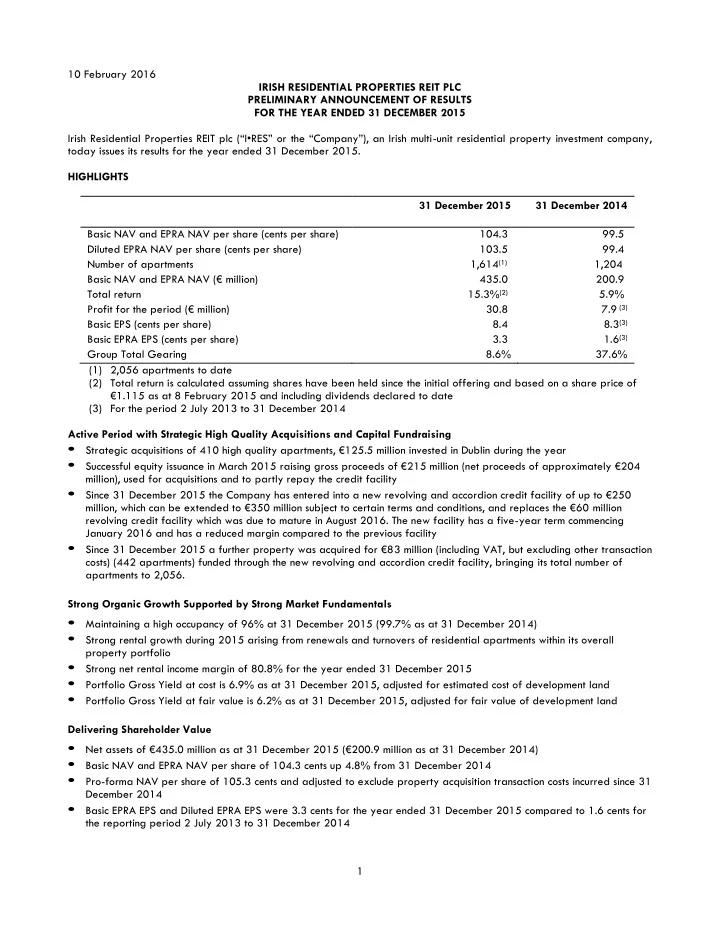

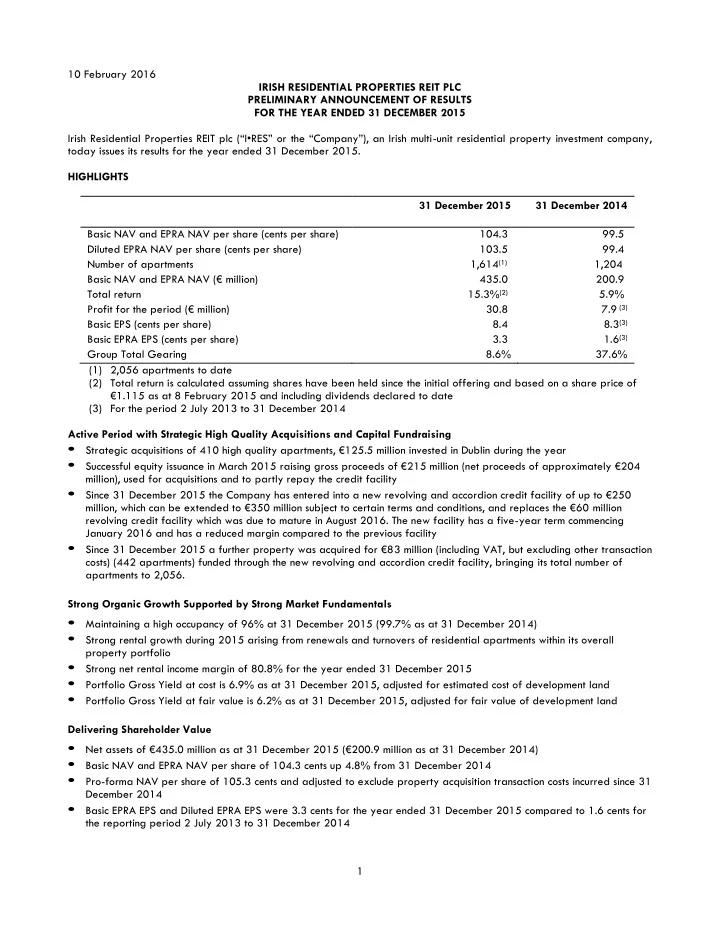

10 February 2016 IRISH RESIDENTIAL PROPERTIES REIT PLC PRELIMINARY ANNOUNCEMENT OF RESULTS FOR THE YEAR ENDED 31 DECEMBER 2015 Irish Residential Properties REIT plc (“I•RES” or the “Company”), an Irish multi -unit residential property investment company, today issues its results for the year ended 31 December 2015. HIGHLIGHTS 31 December 2015 31 December 2014 Basic NAV and EPRA NAV per share (cents per share) 104.3 99.5 Diluted EPRA NAV per share (cents per share) 103.5 99.4 Number of apartments 1,614 (1) 1,204 Basic NAV and EPRA NAV (€ million) 435.0 200.9 Total return 15.3% (2) 5.9% Profit f or the period (€ million) 30.8 7.9 (3) Basic EPS (cents per share) 8.4 8.3 (3) Basic EPRA EPS (cents per share) 3.3 1.6 (3) Group Total Gearing 8.6% 37.6% (1) 2,056 apartments to date (2) Total return is calculated assuming shares have been held since the initial offering and based on a share price of € 1.115 as at 8 February 2015 and including dividends declared to date (3) For the period 2 July 2013 to 31 December 2014 Active Period with Strategic High Quality Acquisitions and Capital Fundraising • Str ategic acquisitions of 410 high quality apartments, €125.5 million invested in Dublin during the year • Successful equity issuance in March 2015 raising gross proceeds of €215 million (net proceeds of approximately €204 million), used for acquisitions and to partly repay the credit facility • Since 31 December 2015 the Company has entered into a new revolving and accordion credit facility of up to €250 million, which can be extended to €350 million subject to certain terms and conditions, and replaces the €60 million revolving credit facility which was due to mature in August 2016. The new facility has a five-year term commencing January 2016 and has a reduced margin compared to the previous facility • Since 31 December 2015 a further property was acquired for €8 3 million (including VAT, but excluding other transaction costs) (442 apartments) funded through the new revolving and accordion credit facility, bringing its total number of apartments to 2,056. Strong Organic Growth Supported by Strong Market Fundamentals • Maintaining a high occupancy of 96% at 31 December 2015 (99.7% as at 31 December 2014) • Strong rental growth during 2015 arising from renewals and turnovers of residential apartments within its overall property portfolio • Strong net rental income margin of 80.8% for the year ended 31 December 2015 • Portfolio Gross Yield at cost is 6.9% as at 31 December 2015, adjusted for estimated cost of development land • Portfolio Gross Yield at fair value is 6.2% as at 31 December 2015, adjusted for fair value of development land Delivering Shareholder Value • Net assets of €435.0 million as at 31 December 2015 (€200.9 million as at 31 December 2014) • Basic NAV and EPRA NAV per share of 104.3 cents up 4.8% from 31 December 2014 • Pro-forma NAV per share of 105.3 cents and adjusted to exclude property acquisition transaction costs incurred since 31 December 2014 • Basic EPRA EPS and Diluted EPRA EPS were 3.3 cents for the year ended 31 December 2015 compared to 1.6 cents for the reporting period 2 July 2013 to 31 December 2014 1

Dividends • Dividends of €1.8 million paid in 2015 in respect of the 2014 accounting period • Since 31 Decembe r 2015, dividends declared of € 13.1 million (DPS of 3.15 cents) for the 2015 fiscal year Positive Outlook • Strong market demand and continued shortage of housing helps support the rental market • Continued support of experienced investment manager with track record of growth and value creation in residential sector • Intensification opportunity to add approximately 600 to 650 apartments with significant infrastructure (e.g. parking) in place, particularly approximately 450 to 500 apartments at Rockbrook, subject to required planning and any other necessary approvals • Strong pipeline of future acquisitions available through NAMA and private market opportunities • Acquisition (including development) capacity in excess of €30 0 million at 31 December 2015 based on a target gearing of 45%, with availability of low cost financing, of which c. €70.5 million has been used subsequent to year end relating to the purchase of a property. (Acquisition capacity to date in excess of €230 million based on a target gearing of 45%). David Ehrlich, the Company’s Chief Executive Officer commented: “Properly acquired and managed rental apartments provide steady and increasing dividends over the long term. This is already proven by our 3.3 cents per share EPRA earnings in only our first full year of operations and despite essentially doubling the number of outstanding shares and having very low leverage for 9 months of 2015. In less than 2 years, I•RES has become the dominant consolidation player in the Irish residential rental market. We believe that it has brought professional management to the rental sector in Ireland and assembled one of the finest quality portfolios for rental apartments anywhere. Using available financing with our new credit facility, with our pipeline of future acquisition opportunities and development intensification opportunities (enhanced by relaxed building regulations within our existing properties), the growing Irish economy and a severe supply and demand imbalance (which is likely to extend for a number of years), our prospects for continued bottom line growth are very positive (notwithstanding the new government limitation on increasing rents every two years, which we believe will be a timing matter as rents continue to grow). In terms of real estate fundamentals, the environment is very strong. We are particularly focused going forward on steady, growing dividends, which will be sustainable over the long term, to create shareholder value. We announced the first development of 68 units at Beacon South Quarter by a press release issued on 9 February 2016 .” 2

Chief Executive Officer’s Statement 2015 was a busy and productive year for I • RES. In March 2015, the Company raised gross proceeds of €215 million through the issuance of 215 million ordinary shares (the “Capital Raise”) , which t ogether with the €200 million raised at the initial offering in April 2014, brings the total gross proceeds raised to €415 million. As the most active consolidators in the Irish residential rental sector, I • RES completed the accretive acquisition of 410 apartments and 4,665 sq. m. (50,214 sq. ft.) of ancillary commercial space during the year. This increased our apartment count by 34% to 1,614 extremely high quality well located apartments in the Dublin area near important transportation links and employment centres. Operationally, we generated solid increases in our key operational performance benchmarks, driven primarily by strong organic growth resulting from high occupancies and solid increases in monthly rents on renewals and turnovers. In 2015, approximately 25% renewed in quarter one and quarter two, and 15% and 10% were renewed in quarter three and quarter four respectively. Also, approximately 20% of the apartments turned over in 2015. On 14 January 2016, the Company signed a new revolving and accordion credit facility of up to €250 million, which can be extended to €350 million subject to certain terms and conditions (the “New Revolving Credit Facility”) . This new facility replaces the €60 million revolvi ng credit facility which was due to mature in August 2016. The new facility has a reduced margin and a five year term. In addition, subsequent to the year ended 31 December 2015, the Company acquired a further 442 apartments and 18,344 sq. m. (197,460 sq. ft.) of commercial space and associated underground car parking at ‘Tallaght Cross West’ located in Tallaght, Dublin 24 for a total purchase price of €83 million (including VAT, but excluding other transaction cost s). The acquisition was mainly funded by our New Revolving Credit Facility. With this acquisition, our total portfolio consists of 2,056 apartments at a total investment of € 526 million to date (including VAT and other acquisition costs). Financial Results Balance Sheet of the Group 1 : 31 December 2015 31 December 2014 Total Property Value (€ million) 472.2 323.6 Basic and EPRA Net Asset Value (€ million) 435.0 200.9 Basic and EPRA NAV per Share (cents per share) 104.3 99.5 Number of apartments 1,614 1,204 Bank Indebtedness (€ million) 41.5 125.0 Group Total Gearing 8.6% 37.6% Year ended 2 July 2013 to Income Statement of the Group: 31 December 2015 31 December 2014 Gross Rental Income (€ million) 24.7 9.7 Net Rental Income (€ million) 20.0 7.6 Profit (€ million) 30.8 7.9 Basic EPS (cents per share) 8.4 8.3 Diluted EPS (cents per share) 8.3 8.3 Basic EPRA EPS (cents per share) 3.3 1.6 The property portfolio was valued at €472.2 million at 31 December 2015 with total net borrowings of €41.5 million, compared to €323.6 million at the end of 2014, with total net borrowings of €125.0 million. For the year ended 2015, there was a significant 6.7% increase in value for the properties held as at 31 December 2014. The Group’s loan to value ratio was 8.6%. 1 This report incorporates the financial information of the Company and its wholly-owned subsidiary, IRES Residential Properties Limited, toge ther referred to as the “Group” for the period from 1 January 2015 to 31 December 2015. 3

Recommend

More recommend