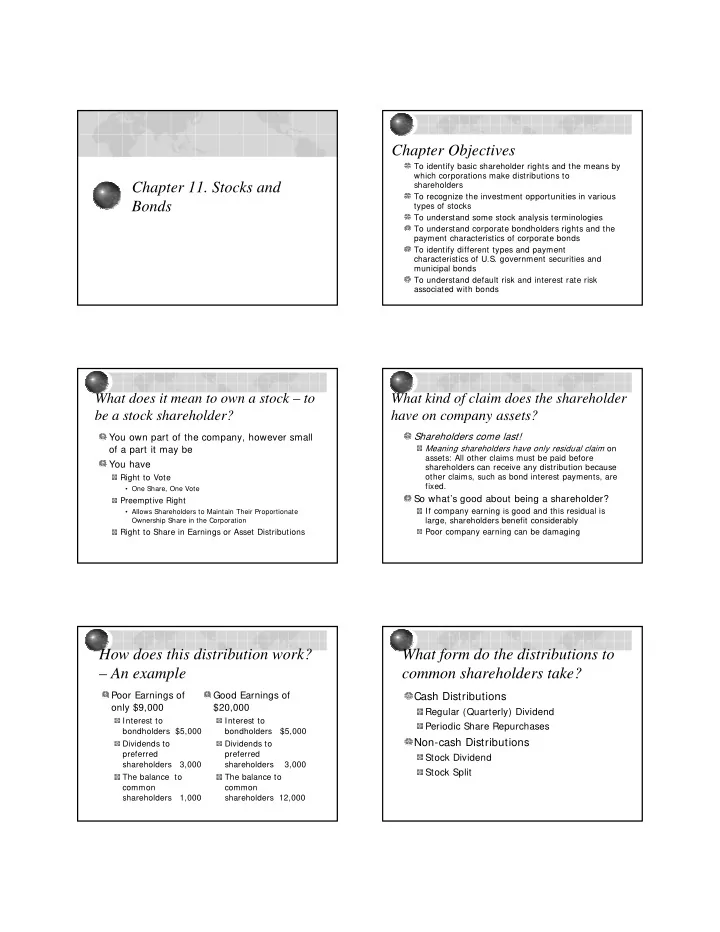

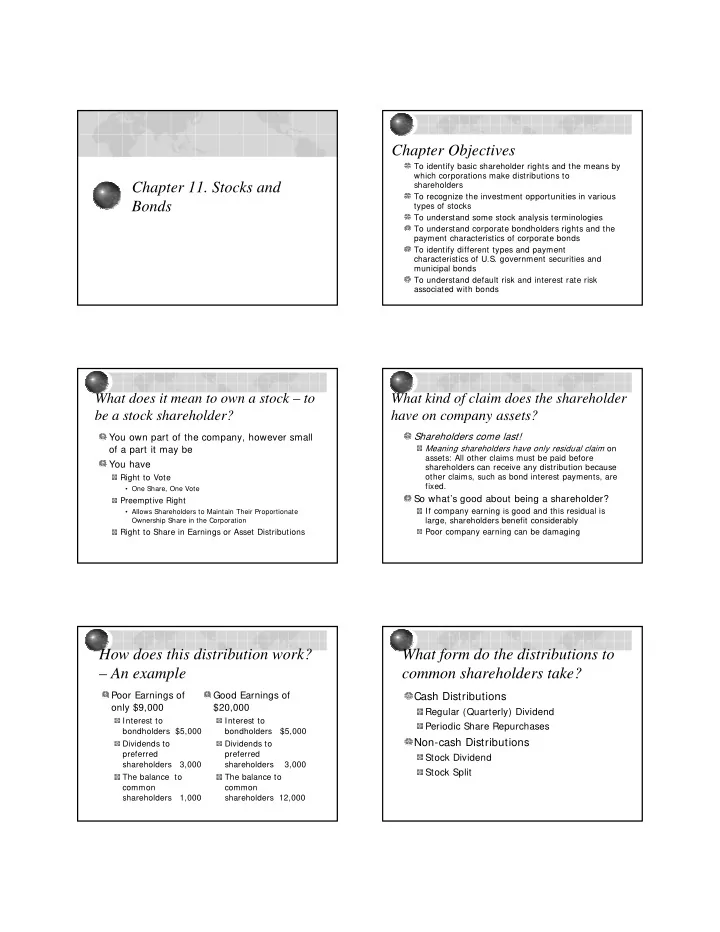

Chapter Objectives To identify basic shareholder rights and the means by which corporations make distributions to Chapter 11. Stocks and shareholders To recognize the investment opportunities in various Bonds types of stocks To understand some stock analysis terminologies To understand corporate bondholders rights and the payment characteristics of corporate bonds To identify different types and payment characteristics of U.S. government securities and municipal bonds To understand default risk and interest rate risk associated with bonds What does it mean to own a stock – to What kind of claim does the shareholder be a stock shareholder? have on company assets? Shareholders come last! You own part of the company, however small of a part it may be Meaning shareholders have only residual claim on assets: All other claims must be paid before You have shareholders can receive any distribution because Right to Vote other claims, such as bond interest payments, are fixed. • One Share, One Vote So what’s good about being a shareholder? Preemptive Right If company earning is good and this residual is • Allows Shareholders to Maintain Their Proportionate Ownership Share in the Corporation large, shareholders benefit considerably Right to Share in Earnings or Asset Distributions Poor company earning can be damaging How does this distribution work? What form do the distributions to – An example common shareholders take? Poor Earnings of Good Earnings of Cash Distributions only $9,000 $20,000 Regular (Quarterly) Dividend Interest to Interest to Periodic Share Repurchases bondholders $5,000 bondholders $5,000 Non-cash Distributions Dividends to Dividends to preferred preferred Stock Dividend shareholders 3,000 shareholders 3,000 Stock Split The balance to The balance to common common shareholders 1,000 shareholders 12,000

What are the opportunities in How to read a stock quotation? common stocks? 52 weeks Growth Companies High Low Stock Div Yld P-E Earnings Are Expected to Grow Substantially % Ratio Income Stocks 40 30 ABC .40 1.0 17 Provide a Good Dividend Return Blue Chips Sales High Low Close Net High Quality Stocks of Established Companies 100s Chg Cyclical Stocks Very Responsive to Changes in the Economy 243 41 39 40 + 0.75 Special Situations Takeover How are stock prices determined? Click here to read a Microsoft stock quote on Yahoo: There are three approaches in stock http://finance.yahoo.com/q?s= msft analysis Fundamental approach – intrinsic value based Technical approach – price movement, empirical models Random-walk approach – unpredictable. luck is the most important factor What is the fundamental analysis What is a stock’s Beta? of common stocks? Beta Measures a Stock’s Risk in Relation Capital Assets Pricing Model (CAPM) to the Overall Market Risk Beta and Alpha < 0: price moves in the opposite direction Price-to-Earnings Analysis of the market – rare Fundamental Value 0: price independent of the market Book Value 0-1.0: less risky than market average For Fundamental Data, Go To Wall 1.0: as risky as market average Street Research Net at > 1.0: riskier than market average http://wsrn.com/

What is price-to-earnings analysis? What is a stock’s Alpha value? A Stock’s P/E Ratio is Alpha = Expected Return- Required Return Expected Return usually are expert the Ratio of a Stock’s Price (P) to Its projections based on company financial Expected Future Earnings Per Share (EPS) numbers Example: P/E = 25.61 Required Return is the return needed to compensate for the risk level measured by Meaning: Investors Pay $25.61 for Each Beta. The higher the Beta, the higher the $1.00 of the Company’s Earnings required return The higher the Alpha, the better value the stocks has. In other words, stocks with high Alpha values are good bets. What is the fundamental value of a What is the market-to-book ratio? stock? A company’s book value is its net worth (assets If you find out the average P/E ratio for all discount minus liabilities) divided by the # of shares outstanding department stores is 25 The market-to-book ratio divides the stock’s price by And Wal-Mart’s next year predicted earnings per its book value. share (EPS) is $2.04 Example: Wal-Mart Data: Then fundamental value for Wal-Mart Book value per share: 8.9 (P/E ratio) * (next-year EPS) = 25* 2.04= $51.00 Stock price: 52.25 So Wal-Mart Stock should be selling at about $51.00 Market to book ratio: 52.25 /8.9= 5.87 a share. If way under, then it’s a good deal. If way All other things equal, analysts prefer low values for higher, then it’s a bad deal. this ratio Historical S&P 500 market-to-book ratio range: 1.13(1980) – 6.98(2000) What is the PEG ratio? What does it mean if you own bond? When you own bond, it means you have Shows the relationship between the PE loaned money to a company or government ratio and the long-term growth rate entity. PEG = (P/E)/Growth Bond Parties Example: Wal-Mart PEG= 1.39 The Issuer Who Borrows Money The Investors Who Lend the Money All things equal, low numbers are The Loan desirable--You’re buying growth at a Has a Maturity, such as 20 Years low price Specifies Interest Payments

What are your rights as a What are the payment characteristics bondholder? for bonds? Bondholders Are Creditors Face Value Bond Indenture: a contract between the Amount the Issuer Pays to Redeem a Bond issuer and the bond holders Usually $1,000 for Corporate Bonds Protective Covenants – restrictions in the Semiannual Interest Payments indenture that strengthen the bondholders’ position Amount Paid Each 6-Month Period Mortgage bonds: secured by collateral Determined by Multiplying a Bond’s Coupon Rate by $1,000; Debentures: no collateral Subordinated debenture: claims given to other • Eg. An 8% Bond Pays $80 Interest a Year (0.08 bond issues x $1,000) with Two Payments of $40 Each What are the retirement methods for bonds? Redemption at Maturity – The Issuer Zero Coupon Bonds Redeems The Bond at Face Value Pay No Periodic Interest Earlier Redemption through a “Call” for Interest is Earned By Paying Less than Callable Bonds $1,000 to Buy the Bond. Sinking Funds • Pay $500 today and Redeem at $1,000 Eight Involve a Plan to Retire A Portion of the Years Later Outstanding Bonds Each Year--Rather than Retiring All at the Maturity Date Conversion to Common Stock What are the factors to consider What are government-issued bonds? when buy bonds? Trading Costs Can Be High U.S. Treasury Securities Commissions U.S. Agency Bonds The Bid-Asked Spread Conventional Must Be Alert to Possible Calls Mortgage-Backed No Interest is Paid after Call Date Municipal Bonds Mutual Funds May Be Best General Obligation (GO) Bonds Revenue Bonds

What are the characteristics of T- What are U.S. Treasury Securities? Bonds? Characteristics are the same as corporate bonds: Treasury bills: mature in 1 year or less Coupon Rate Treasury notes: mature in 2-10 years Face Value of $1,000 A Maturity Date Treasury bonds: mature in 10-30 years Free of default risk Treasury notes and bonds are often May have price risk--degree depends on called T-bonds maturity For more information about Treasury Securities and how to purchase them, click http://www.publicdebt.treas.gov/of/ofbasics. htm What are some special types of What are U.S. agency bonds? Treasury Bonds? Conventional Bonds Have Characteristics Identical to Treasuries U.S. Treasury Strips Created by Brokerage Firms Mortgage-Backed Bonds: Issued in Zero Coupon Form Issued by agencies such as Fannie Mae Inflation-Indexed Bonds Agency buys mortgages from local lenders Redemption value is adjusted periodically Creates a pool of similar mortgages and to reflect inflation. Example: if annual issues bonds backed by the pools inflation is 3%, the redemption value is Mortgage payments are “passed through” to increased to $1,030 the bond buyers Coupon Rate is not Changed How much is the tax advantage of What are municipal bonds? Municipal bonds? General Obligation (GO) Bonds Backed by Full Taxing Authority of the Issuer Depends on your marginal tax rate: the Revenue Bonds higher your marginal tax rate, the more Backed only by the Revenues of the Project the beneficial Bonds Financed Considered Weaker than GO Bonds If a municipal bond offers 3% interest rate, and your marginal tax rate is 27%, then this Most Municipal Bonds Are Free of Federal Income Tax investment is equivalent to a taxable interest rate of 4.11% [3%/(1-27% )]

Recommend

More recommend