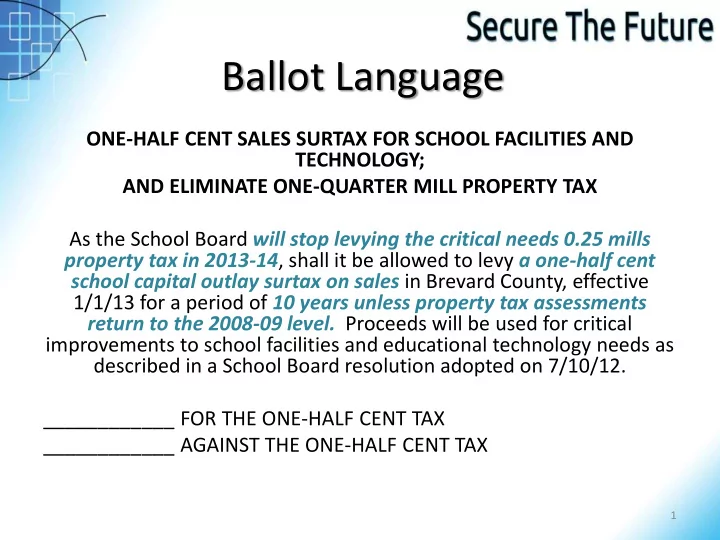

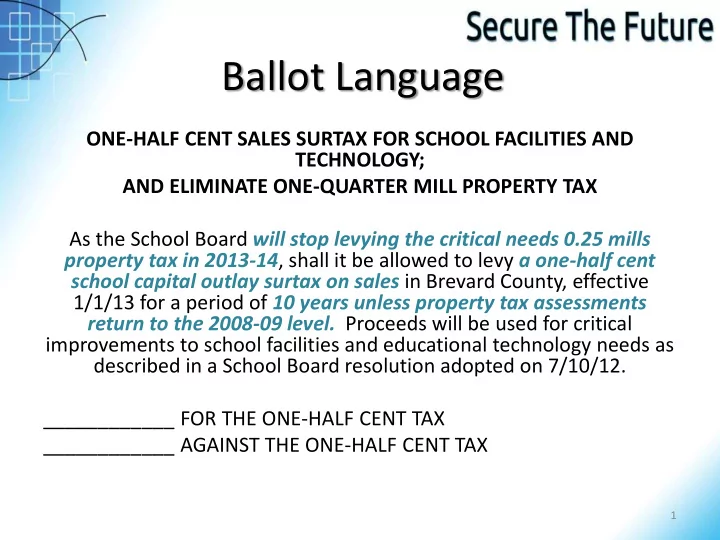

Ballot Language ONE-HALF CENT SALES SURTAX FOR SCHOOL FACILITIES AND TECHNOLOGY; AND ELIMINATE ONE-QUARTER MILL PROPERTY TAX As the School Board will stop levying the critical needs 0.25 mills property tax in 2013-14 , shall it be allowed to levy a one-half cent school capital outlay surtax on sales in Brevard County, effective 1/1/13 for a period of 10 years unless property tax assessments return to the 2008-09 level. Proceeds will be used for critical improvements to school facilities and educational technology needs as described in a School Board resolution adopted on 7/10/12. ____________ FOR THE ONE-HALF CENT TAX ____________ AGAINST THE ONE-HALF CENT TAX 1

How Efficiently Are We Working? 2

Energy Reduction Initiative To Maximize energy use • $15,300,000 2007-2008 and reduce expenditures BPS: • Turned off the heat during winter break (even when • $11,600,000 2011-2012 employees were working) • To save $300,000 this summer, BPS required Percentage • 24% employees to begin work at Saved 6:30 am 3

Insurance Reduction Initiative Administrative Cost Reductions : Streamline third-party • administration • $65,000,000 2007-2008 Employee programs eliminated • Self-funded staff reductions • BPS Self-Funded Health Plan Cost Reductions • $61,800,000 2011-2012 Implemented co-insurance • Participated in Medicare savings • program Negotiated savings in Pharmacy Percentage • 5% • Benefit Manager Saved Implemented preferred health • centers 4

Efficiencies and Priorities • Rezoned students, changed bus routes, and closed schools • BPS historically ranks 2 nd or 3 rd in Florida as to the percentage of dollars spent directly at the school level • BPS historically ranks in the lowest 10 th percentile for the cost of student lunches and has raised prices only one time in 19 years 5

History of Change in Employee Positions Actual 2007-08 vs. Proposed 2012-13 Actual Proposed Change Positions 2007-08 2012-13 Number Percent Classroom Teachers 4,935.07 4,780.76 -154.31 -3.1 Instructional Support 456.70 458.80 2.10 0.5 Instructional Assistants 878.02 835.71 -42.31 -4.8 Support - School-Level 2,713.87 2,355.64 -358.23 -13.2 Administrators - School-Level 242.00 228.00 -14.00 -5.8 Support - District-Level 372.19 334.35 -37.84 -10.2 Administrators - District-Level 50.00 40.00 -10.00 -20.0 Total 9,647.85 9,033.26 -614.59 -6.4 Membership 75,235 73,489 -1,746 -2.3 FTE 73,465.54 71,633.33 -1,832.21 -2.5 6

Are We Working Effectively? 7

Supporting Students for College & Career Readiness • Providing opportunities for students & validation of quality instruction: – BPS pays for and requires every 11 th grade student to take the ACT – BPS pays for every international and industry standard curricula and exams (AP, IB & Industry Certifications) 8

Here are the Results • Juniors outperform state, college-bound peers on the ACT college entrance exam – BPS scores above the state average in all areas • BPS college-bound students outperform college-bound students nationally on the SAT • Students scoring 3 or higher on Advanced Placement: – BPS: 63% – State: 47.6% – Global: 59.2% • We currently have 2,560 10 th -12 th grade students enrolled in a dual enrollment class. – That’s greater than 16% of our students. 9

Career Ready • BPS offers students authentic career preparation: – Career Clusters: business technology, family & consumer sciences, health science, industrial education, marketing , public service, and technology – Career academy themes: engineering, law & public safety, health/wellness/sports medicine, finance, fine arts, education professions, and environmental studies 10

Career Ready Career preparation results: • 60% of middle and high school students enrolled in one or more career classes • 70% of students passed their industry certification • Over 200 career & technical education students earned postsecondary degree or certification from Brevard Community College through dual enrollment 11

Performing Arts • BPS offers a comprehensive arts programming for k-12 • There are 72 high school offerings throughout the district • Of the 21 Florida Music Demonstration Schools, 19 are in Brevard • 15 Brevard schools have received the Excellence in Visual Arts Award from the Brevard Cultural Alliance 12

Excellence as the Standard • Future Problem Solvers: 15 BPS teams/individuals placed in the top 10 in their respective competitions at international competition • Eau Gallie High School’s Air force, JROTC was first in leadership and academic bowl championship in Washington, DC 13

Excellence as the Standard • Four out of eight BPS robotics teams qualified for world championships – Pink team won second in the world • Merritt Island High School is one of only two high schools in the nation chosen to design a satellite to fly on a NASA expendable launch vehicle 14

BPS serves 2.7% of Florida’s Students But in 2012 We Had: • 5.9% of Florida students who earned all-state music recognition • 33% of the first place winners at the state Science & Engineering Fair • 35% of Florida’s public school award winners at the Intel International Science & Engineering Fair • 3.7% of Florida students who met the ACT college readiness benchmark on all four subject-area tests 15

Financial Impact for Families and the Community • Every $1 spent supporting college readiness, $6 are returned back to parents/students in college tuition – AP, ACT, Dual Enrollment, IB, Cambridge • In addition, BPS students earned in 2012, over $44,178,800 in earned scholarships 16

BPS Funding Understanding the Need 17

District Financial Comparison • Brevard has one of the lowest taxable values per student in Florida • Brevard has significant acreage of federally owned property that does not generate tax revenue • Brevard is 25% below the state average in per student property tax assessed value • If Brevard were at the average, it would generate $70,000,000 in additional revenue 18

Do Other Districts Have A Surtax? Yes • Brevard is one of 12 districts out of 67 in Florida without a sales tax above 6% • Two of the other 11 districts had a surtax, but it expired in 2012 • Collectively, the districts without the surtax are 28% above the state average in per student property tax revenue 19

Didn’t We Borrow Money for Renewal? To accommodate the additional annual 1,000+ student growth, renew aging facilities, and meet technology infrastructure, we borrowed approximately $400,000,000 for the 2005-2010 Facilities Plan • We built three new schools • We completed major renovations at various schools • We completed major infrastructure projects But . . . 23 Schools Did Not Receive Renewal 20

Responsible Use of Borrowed Funds We created a small emergency fund. This is how we did it: • We reduced the scope of the 2005-2010 Facilities Plan • We generated interest income by strategically investing borrowed funds • Planned projects came in under budget • The result: creation of reserved savings for 2010-2015 projects 21

Why the Need Now? 22

Capital Funding vs. Need $150,000,000 State Sources Last Year Millage Rate at 2.0 Mills $125,000,000 Local Sources plus Transfer from Operating Legislation Changed to 1.75 Mills $100,000,000 Legislative Option to Reduce to 1.50 Mills &Taxable Value Decline of 11.17% $75,000,000 $50,000,000 Taxable Value Decline of 11.80% $25,000,000 Taxable Value Decline of 14.13% Taxable Value Decline of 1.1% $0 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18

Capital Funding vs. Need $150,000,000 State Sources Last Year Millage Rate at 2.0 Mills $125,000,000 Local Sources plus Transfer from Operating Debt Payments Legislation Changed to 1.75 Mills $100,000,000 Legislative Option to Reduce to 1.50 Mills &Taxable Value Decline of 11.17% $75,000,000 $50,000,000 Taxable Value Decline of 11.80% $25,000,000 Taxable Value Decline of 14.13% Taxable Value Decline of 1.1% $0 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18

Capital Funding vs. Need $150,000,000 State Sources Last Year Millage Rate at 2.0 Mills $125,000,000 Local Sources plus Transfer from Operating Legislation Changed Debt Payments to 1.75 Mills $100,000,000 Legislative Option to Reduce to 1.50 Mills &Taxable Value Decline of 11.17% $75,000,000 $50,000,000 Taxable Value Decline of 11.80% $25,000,000 Taxable Value Decline of 14.13% Taxable Value Decline of 1.1% $0 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18

Capital Funding vs. Need $150,000,000 Last Year Millage $125,000,000 Rate at 2.0 Mills Legislation Changed to 1.75 Mills $100,000,000 Legislative Option to Reduce to 1.50 Mills &Taxable Value Decline of 11.17% $75,000,000 $50,000,000 Taxable Value Decline of 11.80% $25,000,000 Taxable Value Decline of 14.13% Taxable Value Decline of 1.1% $0 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18

Recommend

More recommend