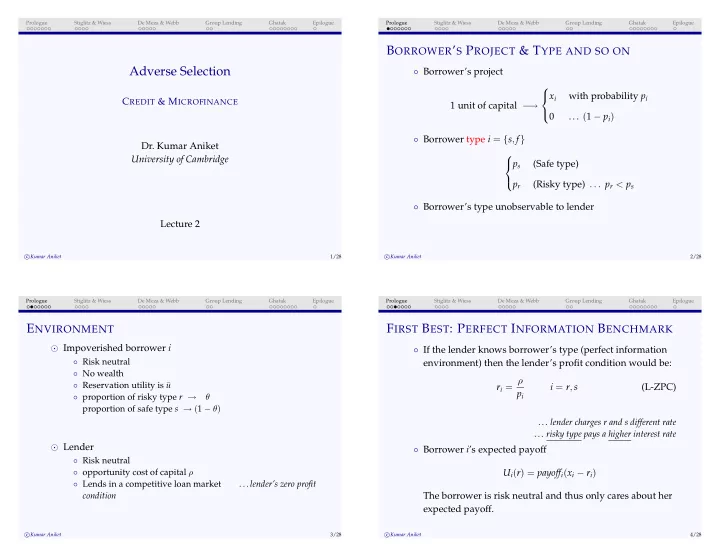

Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue B ORROWER ’ S P ROJECT & T YPE AND SO ON Adverse Selection ◦ Borrower’s project x i with probability p i C REDIT & M ICROFINANCE 1 unit of capital − → 0 . . . ( 1 − p i ) ◦ Borrower type i = { s , f } Dr. Kumar Aniket University of Cambridge p s (Safe type) p r (Risky type) . . . p r < p s ◦ Borrower’s type unobservable to lender Lecture 2 � Kumar Aniket c 1/28 � Kumar Aniket c 2/28 Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue E NVIRONMENT F IRST B EST : P ERFECT I NFORMATION B ENCHMARK ⊙ Impoverished borrower i ◦ If the lender knows borrower’s type (perfect information ◦ Risk neutral environment) then the lender’s profit condition would be: ◦ No wealth r i = ρ ◦ Reservation utility is ¯ u i = r , s (L-ZPC) p i ◦ proportion of risky type r → θ proportion of safe type s → ( 1 − θ ) . . . lender charges r and s different rate . . . risky type pays a higher interest rate ⊙ Lender ◦ Borrower i ’s expected payoff ◦ Risk neutral ◦ opportunity cost of capital ρ U i ( r ) = payoff i ( x i − r i ) ◦ Lends in a competitive loan market . . . lender’s zero profit The borrower is risk neutral and thus only cares about her condition expected payoff. � Kumar Aniket c 3/28 � Kumar Aniket c 4/28

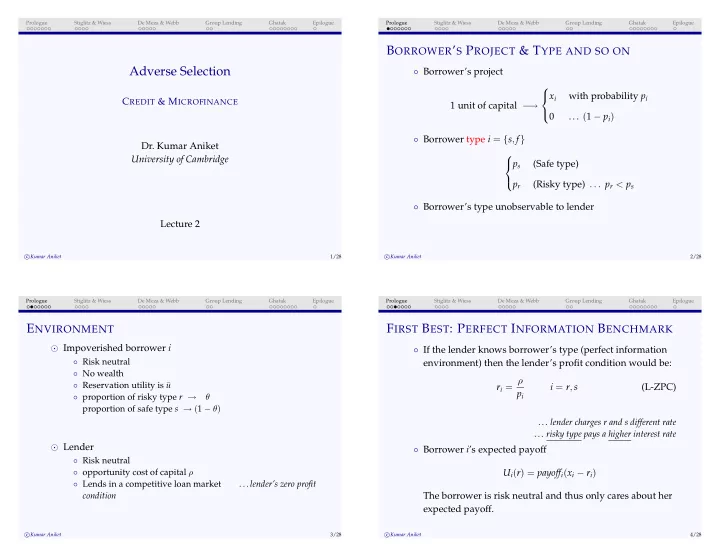

Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue p i S OCIALLY V IABLE P ROJECT Socially Viable Project p s A project is social viable if the expected output is greater than the social cost, in this case, the opportunity cost of capital and 1 − θ reservation wage in this case. p i x i � ρ + ¯ u ¯ p ◦ Under perfect information, all socially viable projects are θ feasible. – The lender would offer the borrowers contracts contingent p i r i = ρ p r on their type and all borrowers’projects would be funded. r i r s r r ¯ r � Kumar Aniket c 5/28 � Kumar Aniket c 6/28 Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue S ECOND B EST : H IDDEN I NFORMATION P ROBLEM I NTEREST R ATE If the lender is ignorant of the borrower’s type, he has the With the zero profit condition, we only have to check for following two options. three interest rates: r s – separating equilibrium with only the safe types either lend to both type - Pooling Equilibrium ¯ r – pooling equilibrium with both types . . . both type pay the same pooling interest rate r r – separating equilibrium with risky types . . . ¯ p = θ p r + ( 1 − θ ) p s (loan repayment probability) r = ρ ¯ (interest rate) ¯ p Timeline: or lend to only one type - Separating Equilibrium Lender would choose the interest rate for the loan . . . interest rate for the type left in the market contract . . . Which type do you think this will be? Borrowers would choose whether to self-select in the p r or p s (loan repayment probability) loan contract r r = ρ and r s = ρ (resp. interest rates) p r p r s � Kumar Aniket c 7/28 � Kumar Aniket c 8/28

Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue I MPERFECT I NFORMATION : A DVERSE S ELECTION P ARTICIPATION C ONSTRAINT : S TIGLITZ & W IESS • Stiglitz & Wiess (1981) Borrower’s Participation Constraint U i ( r j ) = ˆ x − p i r � ¯ i = r , s u p s x s = p r x r = ˆ x . . . the expected project outputs (mean) are identical . . . the risky project has a greater spread around mean ˆ x ◦ may lead to a problem of Under-investment some safe type with socially viable projects, i.e., x = p s x s � ¯ ˆ u + ρ ¯ u . . . driven out of the loan market U risky U safe r 0 � Kumar Aniket c 9/28 � Kumar Aniket c 10/28 Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue P ARTICIPATION C ONSTRAINT : S TIGLITZ & W IESS U NDER -I NVESTMENT : E XCLUSION OF THE S AFE TYPE Borrower’s Participation Constraint type s ’s under-investment U i ( r j ) = ˆ x − p i r � ¯ u i = r , s Expected Socially Viable Projects Output � � p s ρ + u ρ + u – Check participation constraint for both types at r s , ¯ r and r s . p ¯ – Obtain lower threshold of ˆ x at which each type would Figure: Safe type’s under-investment project range self-select into the loan contract. Interest rate Safe type Risky type Under-investment: Some safe agents with socially viable projects U s ( r ) = ˆ x − p s r � ¯ u U r ( r ) = ˆ x − p r r � ¯ u i.e., u + p s x � p r r s = ρ x � ρ + ¯ ˆ u ˆ p s ρ + ¯ u ¯ u + ρ < ˆ x < ¯ p ρ p s ¯ x � p s x � p r ¯ ˆ p ρ + ¯ ˆ p ρ + ¯ r = ρ u u p ¯ ¯ ¯ . . . unable to borrow. x � p s r r = ρ ˆ p r ρ + ¯ ˆ x � ρ + ¯ u u p r � Kumar Aniket c 11/28 � Kumar Aniket c 12/28 Table: Self-selection condition at three interest rates in the Stiglitz Weiss

Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue I MPERFECT I NFORMATION : A DVERSE S ELECTION P ARTICIPATION C ONSTRAINT : D E M EZA & W EBB • De Meza & Webb (1987) Borrower’s Participation Constraint U i ( r ) = p i ( x i − r ) � ¯ u i = r , s p s x > p r x . . . projects have different mean – Check participation constraint for both types at r s , ¯ r and r s . . . . risky project has a lower mean – Obtain lower threshold of ˆ x at which each type would self-select into the loan contract. ◦ may lead to a problem of Over-investment risky type with projects which are not social viable Interest rate Safe type risky type ( p r x < ¯ u + ρ ) may participate in the market at the pooling U s ( r ) = p s x − p s r � ¯ U r ( r ) = p r x − p r r � ¯ u u interest rate. p r x � p r p s x � ρ + ¯ p s ρ + ¯ r s = ρ u u p s p s x � p s p r x � p r r = ρ ¯ p ρ + ¯ p ρ + ¯ u u p ¯ ¯ ¯ p s x � p s r r = ρ p r ρ + ¯ u p r x � ρ + ¯ u p r � Kumar Aniket c 13/28 � Kumar Aniket c 14/28 Table: Self-selection range at interest rates in the De Mezza Webb Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue Prologue Stiglitz & Wiess De Meza & Webb Group Lending Ghatak Epilogue U NDER -I NVESTMENT : D E M EZZA & W EBB type r ’s type s ’s over-investment under-investment Expected Socially Viable Projects type r ’s Output � p s � � p r ρ + u � ρ + u ρ + u over-investment ¯ p ¯ r Expected Socially Viable Projects Output � � p r ρ + u Figure: Under and Over investment Ranges ρ + u ¯ p Figure: Risky type’s over-investment project range • Under-investment: Range of socially viable projects that are not viable due to imperfect information u + p s Over-investment: Risky type agents with projects that are u + ρ < ˆ ¯ x < ¯ p ρ ¯ u + p r not socially viable ( ¯ u + ρ > p r x > ¯ p ρ ) are able to ¯ • Over-investment: Range of socially non-Viable projects that borrow (because they are cross-subsidised by the safe type are viable only due to imperfect information borrowers) . u + p r ¯ p ρ < p r x < ¯ u + ρ ¯ � Kumar Aniket c 15/28 � Kumar Aniket c 16/28

Recommend

More recommend