1

3

Disclaimer Certain statements in this communication may be ‘forward looking statements’ within the meaning of applicable laws and regulations. These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the forward looking statements. Important developments that could affect the Company’s operations include changes in the industry structure, significant changes in political and economic environment in India and overseas, tax laws, import duties, litigation and labour relations. Prince Pipes and Fittings Limited (PPFL) will not be in any way responsible for any action taken based on such statements and undertakes no obligation to publicly update these forward-looking statements to reflect subsequent events or circumstances. 4

Index Industry About Us Key Leadership Overview Strengths Profile Financials Outlook 5

Industry Overview India’s low Per Capita Plastic Consumption vs World Avg. Domestic Plastic Pipes & Fittings Market Size (In Kg) (Rs. bn) 110 World Avg. 30 550 65 ~300 270 250 45 225 205 33 180 11 US Europe China Brazil India FY14 FY15 FY16 FY17 FY18 FY19 FY24P Source: CRISIL Research 6

Types of Polymers & Applications 7

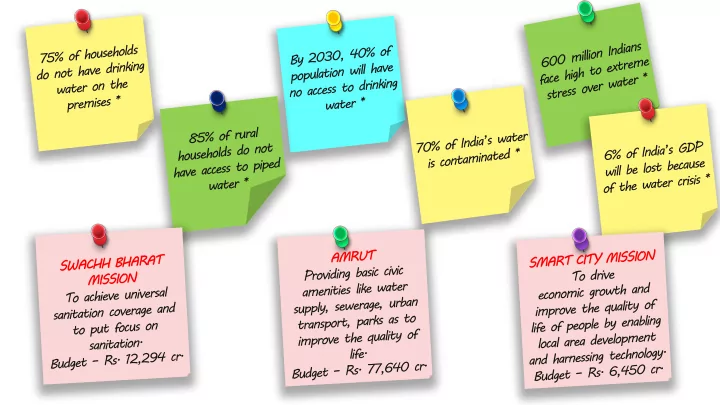

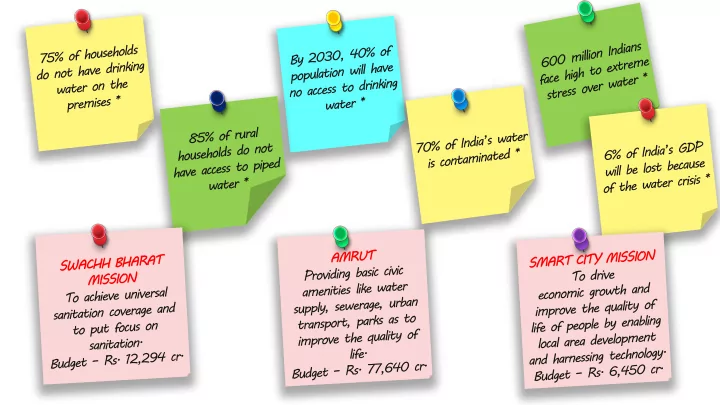

Multiple Growth Drivers Substitution Demand Irrigation from Metal Pipes superior advantages over Irrigation Investment to grow metal pipes at 10%-11% (FY18-FY23) Replacement demand of older Fiscal 2018 Budget increased pipes with plastic pipes allocation to PMKSY Government Initiatives Real Estate Smart Cities Mission and Set up of Jal Shakti Ministry Affordable Housing ’ Nal se Jal’ scheme to offer Urbanisation piped water to every rural (Traction in tier II & III cities) house by 2024 8

Big getting Bigger Prince Pipes is amongst the Front Government Initiatives like Organised Runner Beneficiary Unorganised Pan India manufacturing and distribution network focusing on Service + Scale + Range GST, Demonetisation Major market share up BIS Strict implementation of Building a strong brand equity and for grabs positioning by consciously investing Quality norms into brand building through various ATL, digital, BTL initiatives Value terms (Rs. in Crs.) Scaling up of manufacturing 17.3% 16.5% Multiple Fringe National footprints with two additional 13.1% 13.3% greenfield plants & Regional players facing major balance sheet constraints Demonstrated ability to grow with an P2 P1 PRINCE P3 expanding market share over last 7 PRINCE gains market share over the last Years 7 years compared to its peers Source: Annual Reports 9 Note: P1 to P3 represents our Peers

About Us Promoted by More than 3 Largest Chheda decades of Range of Family Operations SKU’s Strategic Amongst Top Industry’s located 5 Processor in Most Manufacturing Piping Trusted units Industry Brand A wide range of 7,167 SKU’s Over 3 decades of experience Pan India distribution network 6 State of the Art Manufacturing our biggest strength – through in manufacturing multi polymer finding application across facilities located at Haridwar, piping systems Plumbing, Sewage, Irrigation, 1,408 Channel Partners Jaipur, Athal, Dadra, Chennai, Industrial and Underground Kolhapur Drainage UPVC, CPVC, PPR and HDPE Our 7 th State of the Art plant to Further more we have 11 polymers being processed warehouses to focus on come up in Telangana from IPO across our 6 manufacturing efficient supply & timely proceeds facilities service Products sold through our 2 brands Prince and Trubore 10

Strategic Distribution & Factory Network Upcoming Manufacturing Channel Depots Plant Plants Partners Strategic Manufacturing locations Pan India • Freight is a significant part of our Cost structure • Plants located near raw material sources/ports and principal markets to improve cost efficiencies Unique outsourcing Strategy for East India • Hajipur (Bihar) commenced from 2014 • Balasore (Odisha) commenced from 2019 11

Our Journey 12

Continuous Innovation through Thought Leadership 13

Sustained Thought Leadership and Execution Capabilities 14

Quality & Reliability – Our Cornerstones 15

Scaling through Jaipur Plant • Production at Jaipur plant commenced in Sept, 2019 – Installed capacity ~40 kT of ~40kT in next 2-3 year horizon • Being first mover in North India since 2008 with Haridwar • Strong first mover advantage and unparalleled brand equity in Installed Capacity northern India • Jaipur plant- Further improve service to Northern markets as we scale up operations to fortify our market share by efficient supplies and timely service 16

Scaling through Telangana Plant Upcoming integrated 2012 manufacturing Pipe and Acquired Chennai & Approx. 50 kT Fitting facility in Telangana Kolhapur from Chemplast Sanmar Inorganic growth To bolster our endeavour in strategy for South India scaling up our distribution Expected Installed 2020 Way Forward reach and market Capacity* Organic & Integrated penetration in Southern Strategy India Key Advantages Government projects like, affordable Larger tracts of land being brought under housing and water for all an added irrigation advantage Strategically located in the southern market with easy availability of skilled manpower, progressive well managed state, ease of doing business, excellent infrastructure 17 Note: *In next 2-3 year horizon

Brand Play - Winning In Many Indias 18

I. Multiple States - Single Strategy: Transit Media 19

II. Digital Marketing Campaign 20

III. Brand Association – Mission Mangal 21

IV.Pan India-Influencer & Channel Engagement Activities 22

Pan India Presence and Strategy FY15 Sales Profile Geographical spread • First mover in 2008 with Haridwar plant Key • To scale brand 35.8% Strengths 33.9% equity in North 24.7% • 3 Plants across • Next frontier of NORTH different states to growth capture rapid • Asset light model WEST EAST urbanization for 5.7% through efficient supply & SOUTH outsourcing NORTH SOUTH WEST EAST Service • Acquired Chennai FY19 Sales Profile Geographical spread plant and Trubore brand • Setting up of an 38.6% integrated plant in Telangana 26.9% 23.5% Channel 11.0% Partners NORTH SOUTH WEST EAST 23

Multi Polymer Product Basket Key Strengths Wide Range of Pipes & Fittings SKUs 8,085 7,167 7,000 1,600 P1 P2 PRINCE P3 Source: Annual Reports 24 Note: P1 to P3 represents our Peers

Market share gain on multi pronged growth approach Chart Title PRINCE PIPES INCREASING MARKET SHARE v/s PEERS SET 100% Key 12.9% 13.2% 14.2% 14.4% 90% Strengths 80% 14.6% 15.3% 16.7% 15.2% 16.7% 70% 14.6% 60% 34.6% 33.2% 34.0% 34.9% 50% 40% 30% FY16 FY19 20% 38.0% 37.3% 35.5% 36.1% 10% Market share gain in 0% FY16 FY17 FY18 FY19 Volume terms * Assuming Top 4 Players as Market Universe P1 P2 PRINCE P3 1 2 3 To outpace the Over the medium Multi-product and industry growth by term thru multi- multi-brand Approach at least 2-4% location strategy approach Source: Annual Reports 25 Note: P1 to P3 represents our Peers

Execution capability with thrust on margin …..due to improvement in product -mix with rising share of Plumbing/SWR pipes Margin Levers Key Strengths 3.2% 1.1% 1.0% 1.3% 63.5% 64.4% 65.0% 65.5% Product Mix Improvement 35.4% 34.6% 33.7% 31.3% FY16 FY17 FY18 FY19 Brand Monetization Agri Plumbing + SWR Others (incl. DWC) Margin gains due to Favorable Operating Leverage product mix change due to volume growth Higher growth in Plumbing and Drainage Segment v/s Rest of the Portfolio Source: Annual Reports 26 Note: P1 to P3 represents our Peers

Improvement of cash conversion cycle Debtor Days Inventory Days 74 87 67 68 Key 66 50 59 47 Strengths 36 37 FY16 FY17 FY18 FY19 9MFY20 FY16 FY17 FY18 FY19 9MFY20 Creditor Days Working Capital Days 77 78 74 70 60 55 51 49 42 36 FY16 FY17 FY18 FY19 9MFY20 FY16 FY17 FY18 FY19 9MFY20 27

Board of Directors Directors Work Experience Background • Associated with the company since Mr. Jayant S. Chheda incorporation Founder, Chairman and MD • Awarded the Lifetime Achievement Award‘ at Exp. : 40+ Years the Vinyl India Conference, 2014 • Associated with company since 1996, holds an Mr. Parag J. Chheda associate degree in business administration from Executive Director Oakland Community College • Felicitated with the ‘Inspiring Business Leader Exp. : 25+ Years Award – 2016’ at the Economic Times Summit Mr. Vipul J. Chheda • Associated with company since 1997 Executive Director Exp. 22+ years • MBA from University of Chicago - BOOTH Rajesh R. Pai • MD at CID Capital or growth equity investment firm Nominee Director investing growth and expansion stage capital in the US MD & Founder of GEF Capital Partners • Consulting & Operational capacity at American Exp. : 20+ Years Management System, British Telecom and AT&T 28

Recommend

More recommend