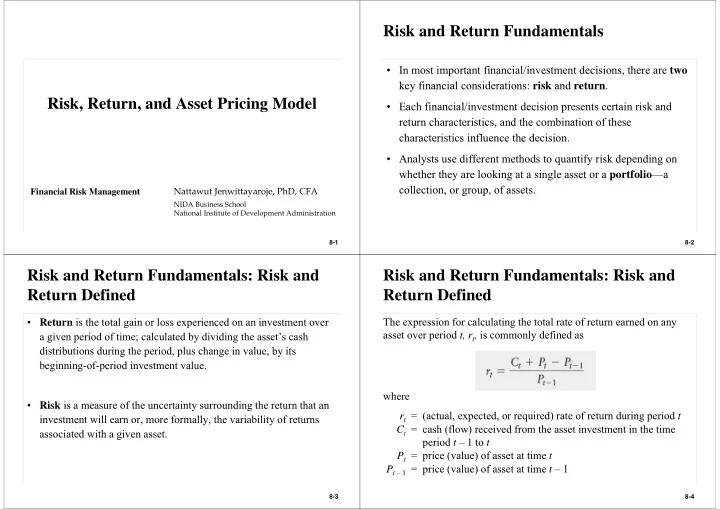

Risk and Return Fundamentals • In most important financial/investment decisions, there are two key financial considerations: risk and return . Risk, Return, and Asset Pricing Model • Each financial/investment decision presents certain risk and return characteristics, and the combination of these characteristics influence the decision. • Analysts use different methods to quantify risk depending on whether they are looking at a single asset or a portfolio —a collection, or group, of assets. Nattawut Jenwittayaroje, PhD, CFA Financial Risk Management NIDA Business School National Institute of Development Administration 8-1 8-2 Risk and Return Fundamentals: Risk and Risk and Return Fundamentals: Risk and Return Defined Return Defined • Return is the total gain or loss experienced on an investment over The expression for calculating the total rate of return earned on any asset over period t, r t , is commonly defined as a given period of time; calculated by dividing the asset’s cash distributions during the period, plus change in value, by its beginning-of-period investment value. where • Risk is a measure of the uncertainty surrounding the return that an r t = (actual, expected, or required) rate of return during period t investment will earn or, more formally, the variability of returns C t = cash (flow) received from the asset investment in the time associated with a given asset. period t – 1 to t P t = price (value) of asset at time t P t – 1 = price (value) of asset at time t – 1 8-3 8-4

Risk and Return Fundamentals: Risk and Expected Return of a Single Asset: Calculation Return Defined (cont.) At the beginning of the year, Apple stock traded for $90.75 per • Expected value of a return ( r ), expected return, is the average return that an investment is expected to produce over time. share, and Wal-Mart was valued at $55.33. During the year, Apple paid no dividends, but Wal-Mart shareholders received dividends of $1.09 per share. At the end of the year, Apple stock was worth where $210.73 and Wal-Mart sold for $52.84. We can calculate the annual rate of return, r, for each stock. r j = return for the j th outcome Apple: ($0 + $210.73 – $90.75) ÷ $90.75 = 132.2% Pr j = probability of occurrence of the j th outcome n = number of outcomes considered Wal-Mart: ($1.09 + $52.84 – $55.33) ÷ $55.33 = –2.5% 8-5 8-6 Expected Return of a Single Asset: Calculation Expected Return of a Single Asset: Calculation (con’t) (con’t) Norman Company wants to choose the better of two investments, A and B. Each requires an initial outlay of $10,000. Norman Company’s past estimates indicate that the probabilities of the pessimistic, most likely, and optimistic outcomes are 25%, 50%, and 25%, respectively. (25%) (50%) (25%) 8-7 8-8

Historical Returns on Selected Investments Risk of a Single Asset: Risk Assessment (1900–2009) • Scenario analysis is an approach for assessing risk that uses several possible alternative outcomes (scenarios) to obtain a sense of the variability among returns. – One common method involves considering pessimistic (worst), most likely (expected), and optimistic (best) outcomes and the returns associated with them for a given asset. • Range is a measure of an asset’s risk, which is found by subtracting the return associated with the pessimistic (worst) outcome from the return associated with the optimistic (best) outcome. 8-9 8-10 Risk of a Single Asset: Risk Assessment (cont.) Risk of a Single Asset: Risk Assessment (cont.) A bar chart is the simplest type of probability distribution; shows A continuous probability distribution is a probability distribution only a limited number of outcomes and associated probabilities for a showing all the possible outcomes and associated probabilities for a given event. given event. From the Norman Company example, bar charts for asset A’s and asset B’s returns are as follows; So, Asset D is more risky than Asset C. 8-11 8-12

The Calculation of the Standard Deviation of the Risk of a Single Asset: Standard Deviation Returns for Assets A and B Standard deviation ( r ) is the most common statistical indicator of an asset’s risk; it measures the dispersion around the expected value. The expression for the standard deviation of returns, r , is In general, the higher the standard deviation, the greater the risk . 8-13 8-14 Historical Returns and Standard Deviations on Bell-Shaped Curve Selected Investments (1900–2009) • Investments with higher returns have higher standard deviations. For • Normal probability distribution a symmetrical probability example, stocks have the highest average return, but also are much more volatile. distribution whose shape resembles a bell-shaped curve. • The historical data confirm the existence of a positive relationship between risk and return. 8-15 8-16

Risk of a Single Asset: Standard Deviation (cont.) Risk and Return Fundamentals: Risk Preferences Economists use three categories to describe how investors Using the data in Table 8.5 and assuming that the probability respond to risk. distributions of returns for common stocks and bonds are normal, we can assume that: – Risk averse is the attitude toward risk in which investors would require an increased return as compensation for an increase in – 68% of the possible outcomes would have a return ranging between risk describes the behavior of most people most of the time. – 11.1% and 29.7% for stocks and between –5.2% and 15.2% for bonds – Risk-neutral is the attitude toward risk in which investors choose the investment with the higher return regardless of its – 95% of the possible return outcomes would range between –31.5% risk. and 50.1% for stocks and between –15.4% and 25.4% for bonds – Risk-seeking is the attitude toward risk in which investors – The greater risk of stocks is clearly reflected in their much wider prefer investments with greater risk even if they have lower range of possible returns for each level of confidence (68% or 95%). expected returns. 8-17 8-18 Return of a Portfolio Return of a Portfolio (Con’t) The return on a portfolio is a weighted average of the returns on James purchases 100 shares of Wal-Mart at a price of $55 the individual assets from which it is formed. per share, so his total investment in Wal-Mart is $5,500. He also buys 100 shares of Cisco Systems at $25 per share, so the total investment in Cisco stock is $2,500. – Combining these two holdings, James’ total portfolio is worth where $8,000. w j = proportion of the portfolio’s total dollar – Of the total, 68.75% is invested in Wal-Mart ($5,500/$8,000) value represented by asset j and 31.25% is invested in Cisco Systems ($2,500/$8,000). r j = return on asset j – Thus, w 1 = 0.6875, w 2 = 0.3125, and w 1 + w 2 = 1.0. 8-19 8-20

Risk of a Portfolio: Portfolio Return and Risk of a Portfolio: Portfolio Return and Standard Standard Deviation (Con’t) Deviation (Con’t) Assume that we wish to determine the expected value and standard deviation of returns for portfolio XY, created by combining equal In case of using historical data to portions(50%) of assets X and Y. The forecasted returns of assets X and Y for each of the next 5 years (2013-2017) are illustrated in Table 8.6. estimate the standard deviation 8-21 8-22 Risk of a Portfolio: Correlation Risk of a Portfolio: Correlation • Correlation is a statistical measure of the relationship (i.e., moving together) between any two series of numbers. – Positively correlated describes two series that move in the same direction. – Negatively correlated describes two series that move in opposite directions. • The correlation coefficient is a measure of the degree of correlation between two series. – Perfectly positively correlated describes two positively correlated series that have a correlation coefficient of +1. See Figure 8.4 . – Perfectly negatively correlated describes two negatively correlated series that have a correlation coefficient of –1. See Figure 8.4 . 8-23 8-24

Risk of a Portfolio: Diversification Risk of a Portfolio: Diversification • To reduce overall risk, it is best to diversify by combining, or adding to the portfolio, assets that have the lowest possible correlation. • For risk averse investors, this is very good news. They get rid • Combining assets that have a low correlation with each other can of risk without having to sacrifice return. reduce the overall variability of a portfolio’s returns. • Even if assets are positively correlated, the lower the correlation between them, the greater the risk reduction that can be achieved through diversification. • Both F and G have the same average return. However, when F’s return is above average, the return on G is below average, and vice versa. • When these two assets are combined in a portfolio, the risk of that portfolio falls without reducing the average return of the portfolio. 8-25 8-26 Forecasted Returns, Expected Values, and Standard Deviations Risk of a Portfolio: Correlation, Diversification, for Assets X, Y, and Z and Portfolios XY and XZ Risk, and Return Consider two assets—Lo and Hi—with the characteristics described in the table below: 8-27 8-28

Recommend

More recommend