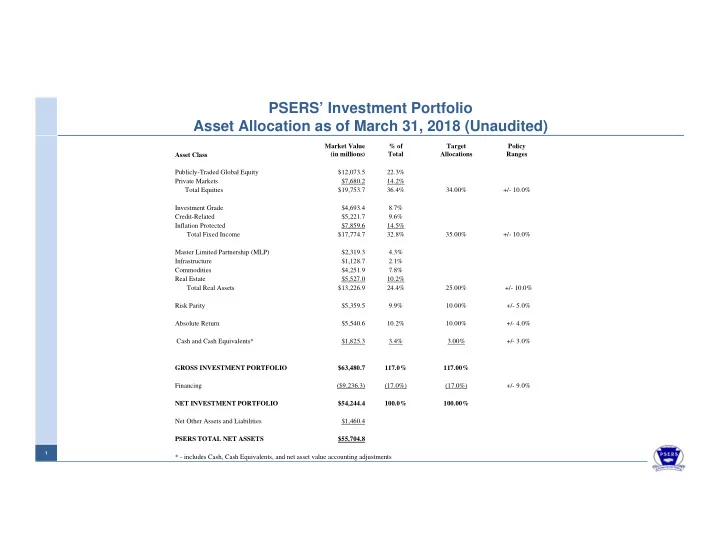

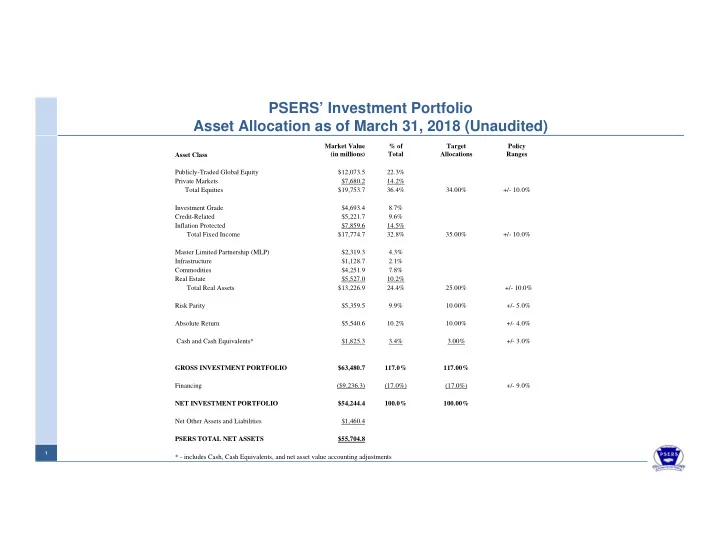

PSERS’ Investment Portfolio Asset Allocation as of March 31, 2018 (Unaudited) Market Value % of Target Policy (in millions) Total Allocations Ranges Asset Class Publicly-Traded Global Equity $12,073.5 22.3% Private Markets $7,680.2 14.2% Total Equities $19,753.7 36.4% 34.00% +/- 10.0% Investment Grade $4,693.4 8.7% Credit-Related $5,221.7 9.6% Inflation Protected $7,859.6 14.5% Total Fixed Income $17,774.7 32.8% 35.00% +/- 10.0% Master Limited Partnership (MLP) $2,319.3 4.3% Infrastructure $1,128.7 2.1% Commodities $4,251.9 7.8% Real Estate $5,527.0 10.2% Total Real Assets $13,226.9 24.4% 25.00% +/- 10.0% Risk Parity $5,359.5 9.9% 10.00% +/- 5.0% Absolute Return $5,540.6 10.2% 10.00% +/- 4.0% Cash and Cash Equivalents* $1,825.3 3.4% 3.00% +/- 3.0% GROSS INVESTMENT PORTFOLIO $63,480.7 117.0% 117.00% Financing ($9,236.3) (17.0%) (17.0%) +/- 9.0% NET INVESTMENT PORTFOLIO $54,244.4 100.0% 100.00% Net Other Assets and Liabilities $1,460.4 PSERS TOTAL NET ASSETS $55,704.8 1 * - includes Cash, Cash Equivalents, and net asset value accounting adjustments

PSERS’ Investment Portfolio Asset Allocation as of March 31, 2018 (Unaudited) 120% Cash and Cash Equivalents, 3.4% 110% Absolute Return, 10.2% 100% Risk Parity, 9.9% 90% Real Estate, 10.2% Total Real Assets Commodities, 7.8% 80% 24.4% Infrastructure, 2.1% MLP, 4.3% 70% Inflation Protected, 14.5% 60% Total Fixed Income 32.8% 50% Credit ‐ Related, 9.6% Investment Grade, 8.7% 40% 30% Private Markets, 14.2% Total Equities 20% 36.5% Publicly Traded Equities, 22.3% 10% 0% Financing, ‐ 17.0% ‐ 10% ‐ 20% 2

PSERS’ Investment Portfolio Asset Allocation as of March 31, 2018 (Unaudited) Cash and Cash Equivalents, 3.4% Absolute Return, 10.2% Publicly Traded Equities, 22.3% Risk Parity, 9.9% Private Markets, 14.2% Real Estate, 10.2% Commodities, 7.8% Investment Grade, 8.7% Infrastructure, 2.1% MLP, 4.3% Credit ‐ Related, 9.6% Inflation Protected, 14.5% *Financing represents a negative 17.0% allocation and is not reflected in the pie chart. 3

PSERS’ Historical Asset Allocation 60% 50% 40% 30% 20% 10% 0% ‐ 10% ‐ 20% ‐ 30% U.S. Equity Non ‐ U.S. Equity Fixed Income Real Estate Private Markets Absolute Return MLP Infrastructure Risk Parity Commodities Cash & Cash Equivalents Financing 4

PSERS’ Historical Net Investment Portfolio (in billions) $80 67.2 $70 62.7 57.0 $60 52.4 52.9 54.5 54.2 53.4 52.7 51.9 51.8 51.4 48.5 49.2 49.2 48.9 48.1 48.3 $50 45.7 44.8 43.5 42.3 43.1 39.3 $40 33.7 28.8 $30 17.3 $20 $10 4.9 2.1 0.8 $0 Month/Year 5

PSERS’ Gross Investment Portfolio Internally Managed Assets (in billions) $80 $70 $60 $50 $40 $30 $20 $10 $0 Gross Investment Portfolio Internally Managed Assets 6

PSERS’ Summary Statements of Changes in Plan Net Assets For the Fiscal Years Ended June 30 2017 2016 2015 2014 2013 Additions: ( $ in millions) ( $ in millions) ( $ in millions) ( $ in millions) ( $ in millions) • Member Contributions 1,014 989 985 967 991 • Employer Contributions 3,833 3,190 2,597 1,992 1,446 • Net Investment Income 4,995 473 1,328 7,098 4,126 Total Additions 9,842 4,652 4,910 10,057 6,563 Deductions: • Pension Benefits 6,474 6,360 6,221 6,053 6,044 • Administrative Expenses 45 45 42 39 37 Total Deductions 6,519 6,405 6,263 6,092 6,081 Net Increase/(Decrease) in Plan Net Assets 3,323 (1,753) (1,353) 3,965 482 7

PSERS Annual Cash Flows History – Since 1982 (in billions) $10 10.0% $8 8.0% $6 6.0% $4 4.0% $2 2.0% $0 0.0% 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 ($2) (2.0%) ($4) (4.0%) ($6) (6.0%) ($8) (8.0%) ($10) (10.0%) Member Contributions ($) Employer Contributions ($) Benefit Payments ($) Net Cash Flow Shortfall ($) Cash Flow Excess/Shortfall as % of Beginning NAV (%) 8

PSERS Annual Cash Flows History – Since 2001 (in billions) $10 10.0% $8 8.0% $6 6.0% $4 4.0% $2 2.0% $0 0.0% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 ($2) (2.0%) ($4) (4.0%) ($6) (6.0%) ($8) (8.0%) ($10) (10.0%) Member Contributions ($) Employer Contributions ($) Benefit Payments ($) Net Cash Flow Shortfall ($) Cash Flow Excess/Shortfall as % of Beginning NAV (%) 9

Recommend

More recommend