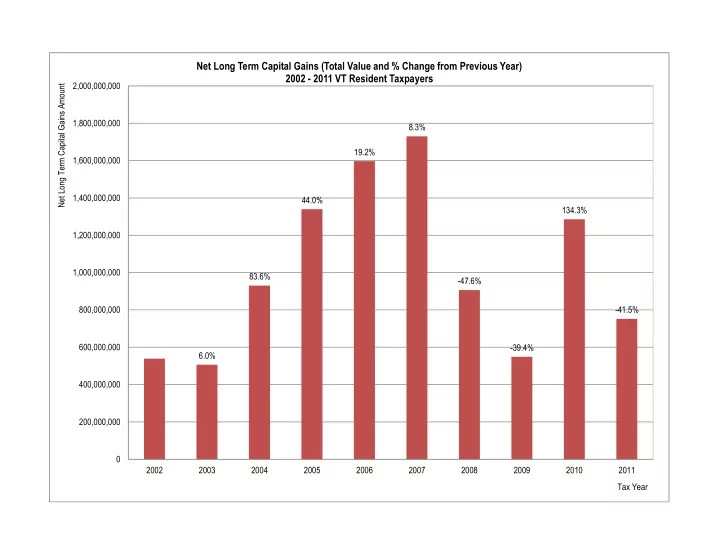

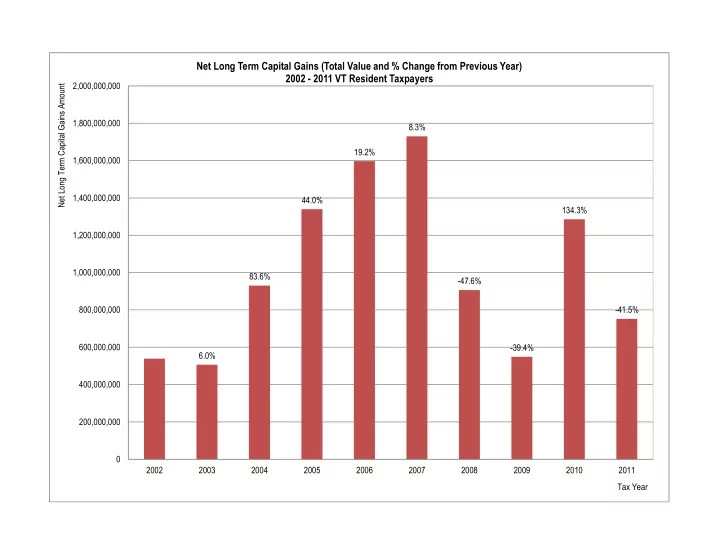

Net Long Term Capital Gains (Total Value and % Change from Previous Year) 2002 - 2011 VT Resident Taxpayers 2,000,000,000 Net Long Term Capital Gains Amount 1,800,000,000 8.3% 19.2% 1,600,000,000 1,400,000,000 44.0% 134.3% 1,200,000,000 1,000,000,000 83.6% -47.6% 800,000,000 -41.5% 600,000,000 -39.4% 6.0% 400,000,000 200,000,000 0 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Tax Year

% of Net Long Term Capital Gains 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% 0.0% 5.0% 0.9% Negative 0.0% None/Missing 0.2% 0.01 - 4,999 0.3% 5,000 - 9,999 0.5% 10,000 - 14,999 0.5% Percent of Net Long Term Capital Gains by AGI Income Class 15,000 - 19,999 0.5% 20,000 - 24,999 0.6% 25,000 - 29,999 10 Year History (2002 - 2011) 0.6% 30,000 - 34,999 0.6% 35,000 - 39,999 0.7% 40,000 - 44,999 0.7% 45,000 - 49,999 1.6% 50,000 - 59,999 2.7% 60,000 - 74,999 4.6% 75,000 - 99,999 4.1% 100,000 - 124,999 3.6% 125,000 - 149,999 6.0% 150,000 - 199,999 7.9% 200,000 - 299,999 Adjusted Gross Income 8.6% 300,000 - 499,999 10.0% 500,000 - 999,999 44.8% 1,000,000 +

Vermont Capital Gains Exclusion 40% Exclusion $5,000 Exemption TOTAL Percent of Expenditure Average Tax Savings *Value of Cap Amount of PI *Value of Cap Amount of PI *Value of Cap Amount of PI #Claimants #Claimants #Claimants 40% Flat $5K 40% Flat $5K Gains Excluded Tax not paid Gains Excluded Tax not paid Gains Excluded Tax not paid 71% 29% 6,060 127 TY2011 1,352 142,923,845 8,193,513 26,343 68,394,178 3,354,130 27,695 211,318,023 11,547,643 TY2012 1,799 309,137,143 13,076,851 33,054 84,368,462 4,183,249 34,853 393,505,605 17,260,100 76% 24% 7,269 127 80% 20% 3,634 64 TY2013 1,713 84,284,370 6,224,881 24,057 33,801,073 1,549,702 25,770 118,085,443 7,774,583 Data source: Vermont Department of Taxes Analysis: JFO/st

Taxation of Capital Gains in Vermont Prior to TY 2002 Until 2002, Vermont applied its state personal income tax as a percentage of the federal tax and followed the federal treatment of capital gains. In 2002, when Vermont decoupled and began using federal taxable income as its starting point for the personal income tax the treatment of capital gains changed. TY 2002 to TY 2008 From 2002 until 2008, taxpayers excluded 40% of their federally defined, net, long-term, capital gains from the income tax. The remaining 60% was taxed at the ordinary personal income tax rates. The only state change to the treatment of capital gains during this time was to limit the amount of the exclusion to no more than 40% of the taxpayer’s federal taxable income in tax year 2008. TY 2009 (January – June) In tax year 2009 significant changes were made to the taxation of capital gains. The first half of the tax year (from January through June) the taxation was the same as the prior year. TY 2009 (July – December) and TY 2010 Beginning on July 1, 2009 the percentage exclusion amount was converted to a flat exclusion amount for most capital gains. For half of tax year 2009 and all of tax year 2010, taxpayers excluded the first $2,500 of capital gains from the personal income tax, with any additional amount of capital gains taxed according to the regular Vermont rate and bracket schedule (the marginal rates were simultaneously reduced). The capital gains from the sale of standing timber and farms retained the previous 40% exclusion. Taxpayers over age 70 were given the choice of which method was more beneficial; the prior 40% exclusion, or the new flat $2,500 exclusion. TY 2011 and after Taxpayers whose capital gains are from certain business assets held for more than 3 years, may again exclude 40% with the remaining amount taxed at the state rate and bracket structure. The total amount excluded may not exceed 40% of federal taxable income. A flat $5,000 exclusion applies to three types of capital gains: 1) stocks or bonds publicly traded on an exchange or any other financial instruments, 2) depreciable personal property that is not farm property or standing timber, 3) real estate that is used by the taxpayer as a primary or non primary residence. Any amount greater than $5,000 is taxed at the ordinary state tax rates.

Recommend

More recommend