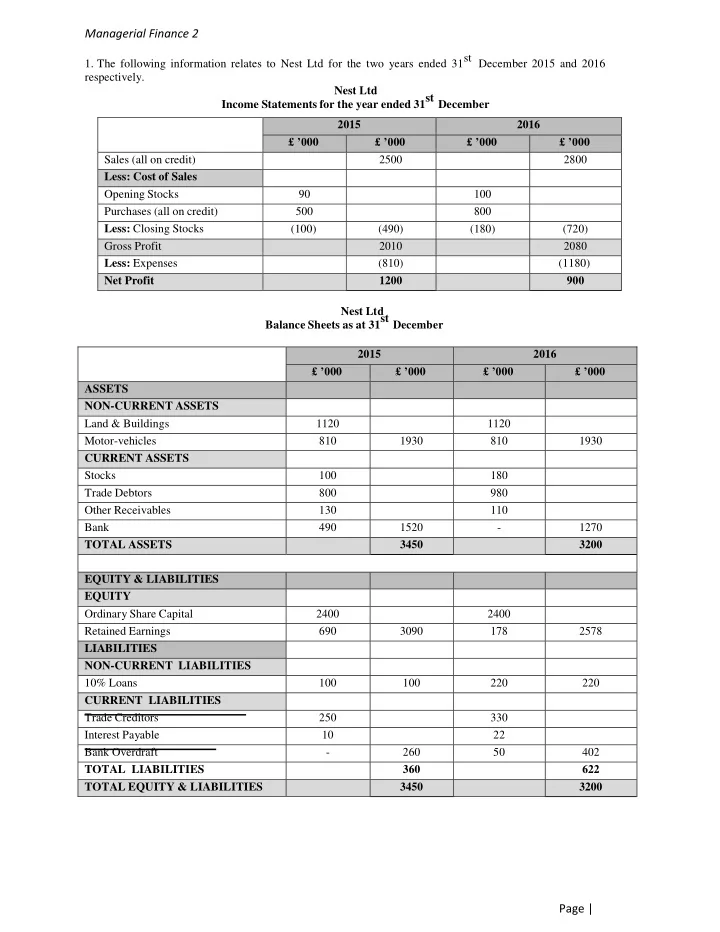

Managerial Finance 2 1. The following information relates to Nest Ltd for the two years ended 31st December 2015 and 2016 respectively. Nest Ltd Income Statements for the year ended 31st December 2015 2016 £ ’0 00 £ ’0 00 £ ’0 00 £ ’0 00 Sales (all on credit) 2500 2800 Less: Cost of Sales Opening Stocks 90 100 Purchases (all on credit) 500 800 Less: Closing Stocks (100) (490) (180) (720) Gross Profit 2010 2080 Less: Expenses (810) (1180) Net Profit 1200 900 Nest Ltd Balance Sheets as at 31st December 2015 2016 £ ’0 00 £ ’0 00 £ ’0 00 £ ’0 00 ASSETS NON-CURRENT ASSETS Land & Buildings 1120 1120 Motor-vehicles 810 1930 810 1930 CURRENT ASSETS Stocks 100 180 Trade Debtors 800 980 Other Receivables 130 110 Bank 490 1520 - 1270 TOTAL ASSETS 3450 3200 EQUITY & LIABILITIES EQUITY Ordinary Share Capital 2400 2400 Retained Earnings 690 3090 178 2578 LIABILITIES NON-CURRENT LIABILITIES 10% Loans 100 100 220 220 CURRENT LIABILITIES Trade Creditors 250 330 Interest Payable 10 22 Bank Overdraft - 260 50 402 TOTAL LIABILITIES 360 622 TOTAL EQUITY & LIABILITIES 3450 3200 Page | 150150150

Managerial Finance 2 Required: Calculate the following accounting ratios for the two years 2015 and 2016 respectively. 1) Gross Profit Ratio 2) Net Profit Ratio 3) Return On Capital Employed 4) Stock Turnover 5) Debtors Collection Period 6) Creditors Settlement Period 7) Current Ratio 8) Acid Test/Quick Assets Ratio 9) Gearing Ratio Page | 151151151

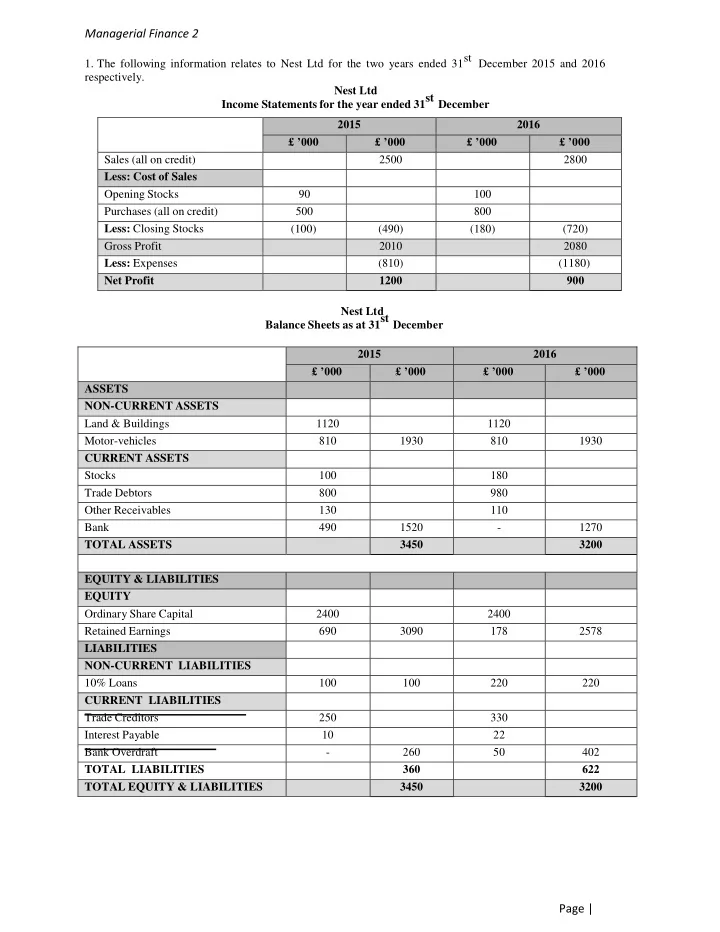

Managerial Finance 2 2. The following information relates to Zap Ltd for the two years ended 30th March 2015 and 2016 respectively. Zap Ltd Income Statements for the year ended 30th March 2015 2016 £ ’0 00 £ ’0 00 £ ’0 00 £ ’0 00 Sales (all on credit) 3000 2500 Less: Cost of Sales Opening Stocks 100 200 Purchases (all on credit) 400 550 Less: Closing Stocks (200) (300) (150) (600) Gross Profit 2700 1900 Less: Expenses (1700) (800) Net Profit 1000 1100 Zap Ltd Balance Sheets as at 30th March 2010 2011 £ ’0 00 £ ’0 00 £ ’0 00 £ ’0 00 ASSETS NON-CURRENT ASSETS Land & Building 1500 1600 Motor-vehicles 500 2000 700 2300 CURRENT ASSETS Stocks 200 150 Trade Debtors 800 850 Other Receivables 100 200 Bank 200 1300 - 1200 TOTAL ASSETS 3300 3500 EQUITY & LIABILITIES EQUITY Ordinary Share Capital 2000 2200 Retained Earnings 500 2500 700 2900 LIABILITIES NON-CURRENT LIABILITIES 10% Loans 50 50 100 100 CURRENT LIABILITIES Trade Creditors 740 400 Interest Payable 10 10 Bank Overdraft - 750 90 500 TOTAL LIABILITIES 800 600 TOTAL EQUITY & LIABILITIES 3300 3500 Page | 152152152

Managerial Finance 2 Required: Calculate the following accounting ratios for the two years 2010 and 2011 respectively. 1) Gross Profit Ratio 2) Net Profit Ratio 3) Return On Capital Employed 4) Stock Turnover Ratio 5) Current Ratio 6) Acid Test Ratio 7) Debtors Collection Period 8) Creditors Settlement Period 9) Gearing Ratio Page | 153153153

Recommend

More recommend