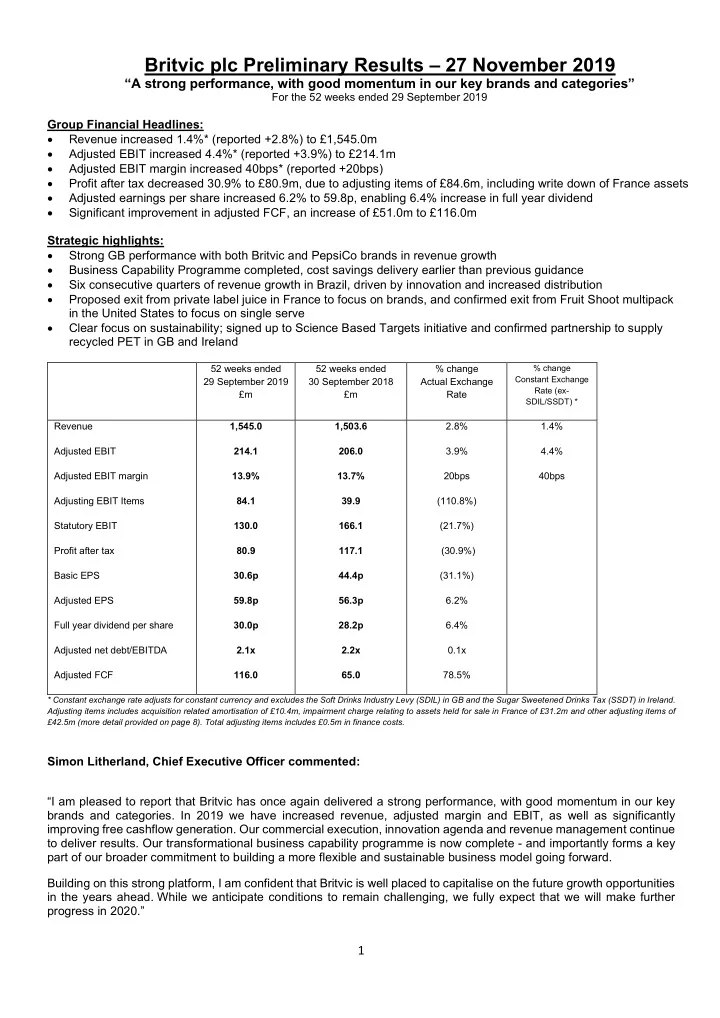

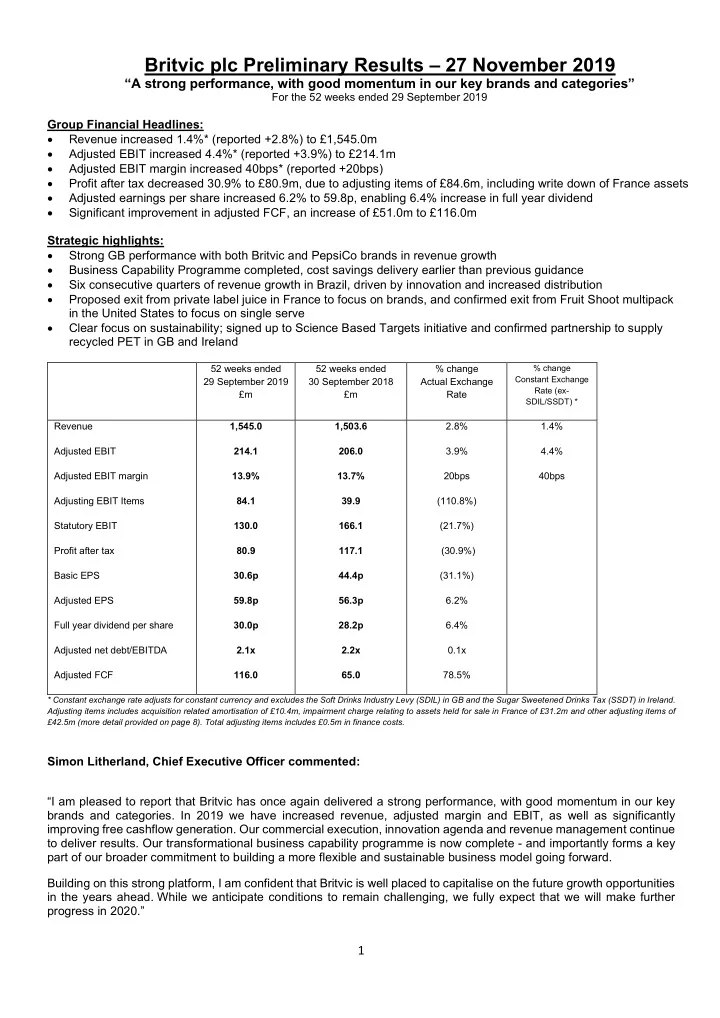

Britvic plc Preliminary Results – 27 November 2019 “A strong performance, with good momentum in our key brands and categories” For the 52 weeks ended 29 September 2019 Group Financial Headlines: • Revenue increased 1.4%* (reported +2.8%) to £1,545.0m • Adjusted EBIT increased 4.4%* (reported +3.9%) to £214.1m • Adjusted EBIT margin increased 40bps* (reported +20bps) • Profit after tax decreased 30.9% to £80.9m, due to adjusting items of £84.6m, including write down of France assets • Adjusted earnings per share increased 6.2% to 59.8p, enabling 6.4% increase in full year dividend • Significant improvement in adjusted FCF, an increase of £51.0m to £116.0m Strategic highlights: • Strong GB performance with both Britvic and PepsiCo brands in revenue growth • Business Capability Programme completed, cost savings delivery earlier than previous guidance • Six consecutive quarters of revenue growth in Brazil, driven by innovation and increased distribution • Proposed exit from private label juice in France to focus on brands, and confirmed exit from Fruit Shoot multipack in the United States to focus on single serve • Clear focus on sustainability; signed up to Science Based Targets initiative and confirmed partnership to supply recycled PET in GB and Ireland 52 weeks ended 52 weeks ended % change % change Constant Exchange 29 September 2019 30 September 2018 Actual Exchange Rate (ex- £m £m Rate SDIL/SSDT) * Revenue 1,545.0 1,503.6 2.8% 1.4% Adjusted EBIT 214.1 206.0 3.9% 4.4% Adjusted EBIT margin 13.9% 13.7% 20bps 40bps Adjusting EBIT Items 84.1 39.9 (110.8%) Statutory EBIT 130.0 166.1 (21.7%) Profit after tax 80.9 117.1 (30.9%) Basic EPS 30.6p 44.4p (31.1%) Adjusted EPS 59.8p 56.3p 6.2% Full year dividend per share 30.0p 28.2p 6.4% Adjusted net debt/EBITDA 2.1x 2.2x 0.1x Adjusted FCF 116.0 65.0 78.5% * Constant exchange rate adjusts for constant currency and excludes the Soft Drinks Industry Levy (SDIL) in GB and the Sugar Sweetened Drinks Tax (SSDT) in Ireland. Adjusting items includes acquisition related amortisation of £10.4m, impairment charge relating to assets held for sale in France of £31.2m and other adjusting items of £42.5m (more detail provided on page 8). Total adjusting items includes £0.5m in finance costs. Simon Litherland, Chief Executive Officer commented: “I am pleased to report that Britvic has once again delivered a strong performance, with good momentum in our key brands and categories. In 2019 we have increased revenue, adjusted margin and EBIT, as well as significantly improving free cashflow generation. Our commercial execution, innovation agenda and revenue management continue to deliver results. Our transformational business capability programme is now complete - and importantly forms a key part of our broader commitment to building a more flexible and sustainable business model going forward. Building on this strong platform, I am confident that Britvic is well placed to capitalise on the future growth opportunities in the years ahead. While we anticipate conditions to remain challenging, we fully expect that we will make further progress in 2020.” 1

For further information please contact: Investors: Steve Nightingale (Director of Investor Relations) +44 (0) 7808 097784 Media: Kathryn Partridge (Director of Corporate Relations) +44 (0) 7803 854229 Megan Ratcliffe (Head of Corporate Communications) +44 (0) 7808 097769 Stephen Malthouse (Headland) +44 (0) 203 805 4822 There will be a live webcast of the presentation given today at 09:00am by Simon Litherland (Chief Executive Officer) and Joanne Wilson (Chief Financial Officer). The webcast will be available at www.britvic.com/investors with a transcript available in due course. Notes to editors About Britvic Britvic is one of the leading branded soft drinks businesses in Europe. The company combines its own leading brand portfolio including Fruit Shoot, Robinsons, Tango, J2O, London Essence, Teisseire and MiWadi with PepsiCo brands such as Pepsi, 7UP, Arto LIFEWTR and Lipton Ice Tea which Britvic produces and sells in GB and Ireland under exclusive PepsiCo agreements. Britvic is the largest supplier of branded still soft drinks in Great Britain (“GB”) and the number two supplier of branded carbonated soft drinks in GB. Britvic is an industry leader in the island of Ireland with brands such as MiWadi and Ballygowan, in France with brands such as Teisseire, Pressade and Moulin de Valdonne and in Brazil with Maguary, Bela Ischia and Dafruta. Britvic is growing its reach into other territories through franchising, export and licensing. Britvic's management team has successfully developed the business through a clear strategy of organic growth and international expansion based on creating and building scale brands. Britvic is listed on the London Stock Exchange under the code BVIC and is a constituent of the FTSE250 index. Cautionary note regarding forward-looking statements This announcement includes statements that are forward-looking in nature. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the group to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Except as required by the Listing Rules and applicable law, Britvic undertakes no obligation to update or change any forward-looking statements to reflect events occurring after the date such statements are published. Market data GB take-home market data referred to in this announcement is supplied by Nielsen and runs to 28 September 2019. ROI take-home market data referred to is supplied by Nielsen and runs to 8 September 2019. French market data is supplied by Nielsen and runs to 8 September 2019. Next scheduled announcement Britvic will publish its quarter one trading statement on 31 January 2020. 2

Recommend

More recommend