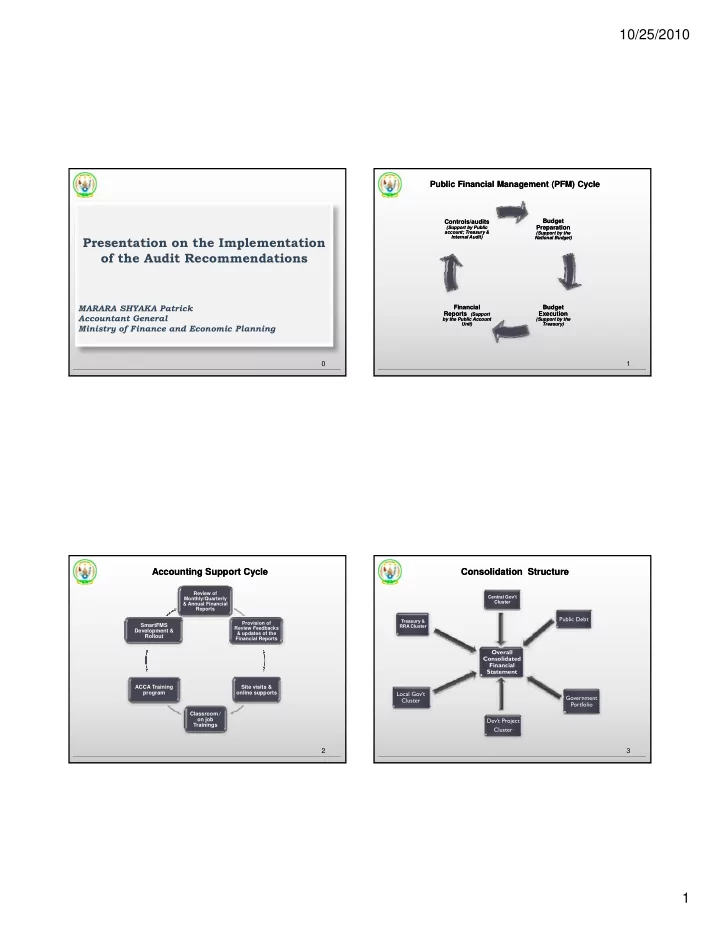

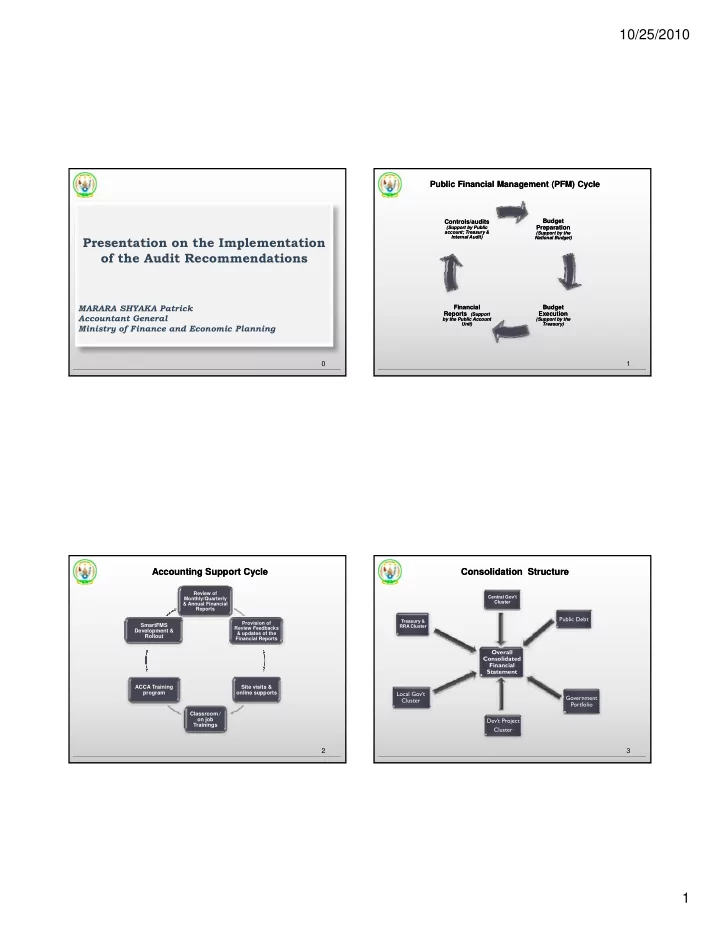

10/25/2010 Public Financial Management (PFM) Cycle Public Financial Management (PFM) Cycle Budget Budget Controls/audits Controls/audits (Support by Public (Support by Public Preparation Preparation account; Treasury & account; Treasury & (Support by the (Support by the Presentation on the Implementation Internal Audit) Internal Audit) National Budget) National Budget) of the Audit Recommendations MARARA SHYAKA Patrick Financial Financial Budget Budget Reports (Support Reports (Support Execution Execution Accountant General by the Public Account by the Public Account (Support by the (Support by the Unit) Unit) Treasury) Treasury) Ministry of Finance and Economic Planning 0 1 Accounting Support Cycle Accounting Support Cycle Consolidation Structure Consolidation Structure Review of Central Gov’t Monthly/Quarterly Cluster & Annual Financial Reports Public Debt Treasury & Provision of SmartFMS RRA Cluster Review Feedbacks Development & & updates of the Rollout Financial Reports Overall Consolidated Consolidated Financial Statement ACCA Training Site visits & program online supports Local Gov’t Government Cluster Portfolio Classroom / on job Dev’t Project Trainings Cluster 2 3 1

10/25/2010 Implementation of recommendations by the Control/Audits Implementation of recommendations by the Control/Audits Implementation of recommendations by the Control/Audits Implementation of recommendations by the Control/Audits Key recommendations Actions taken Key recommendations Actions taken Timely Submission of GoR Consolidated Financial Statements Improvement in internal Regular Class room & on-the-job training continues to be Improvement in the control systems; to the Auditor General has been improved present one was maintenance of accounting held for Budget Officers, Accountants, Directors of Finance submitted by 30 th September; records and reporting of and Chief Budget Managers. This includes sensitizing the financial Statements; trainees on the general audit findings and the need to Regarding insufficient supported expenditures and implement audit recommendations in their various budget procurement irregularities, they are underway being handled agencies and compliance with policies and procedures. by Internal auditors/audit committees & RPPA respectively; The latest training covered the entire aspect of the PFM Audit committees are being set up across Government and g p cycle (planning, budgeting, procurement, accounting and will be expected to investigate issues raised and implement reporting and oversight) and the OAG provided facilitators audit recommendations; for the training as well; MINECOFIN enforcing the submission of monthly financial The IFMIS project implementation team was beefed up statements from all budget agencies and projects and levies and this has led to the roll out of the core modules of the prohibitive penalties for defaulters; system to 94 out of 284 budget agencies. The IFMIS has Training of the Finance units; Improvement in the enhanced internal controls and will help minimize record management of bank Closing some redundant accounts, but we also believe that keeping errors and omissions as well as ensure control accounts opened & over the management of bank accounts; some of these issues can be solved with the joint efforts from maintained by Budget our stakeholders via reduction of requests to open separate Agencies; bank accounts; 4 5 Implementation of recommendations by the Control/Audits Implementation of recommendations by the Control/Audits Implementation of recommendations by the Control/Audits Implementation of recommendations by the Control/Audits Key recommendations Actions taken Key recommendations Actions taken The recently set-up Government Portfolio Unit has Improvement in the reconciliation Discrepancy between Treasury cashbook and Improvement in the management of recoverable amounts from GBEs; been beefed up with resources and skills via on-the- between Treasury cashbook & Smartgov Smartgov data has been corrected as per the budget execution system; current situation since there has been full job training in order to oversee the efficient operations reconciliation; of the GBEs and follow up any receivables; Regular Dividends receivables from Government Investments Improvement in the procurement system Class room & on-the-job training & filing of documents; continues to be held for Budget Officers, are all presently recorded; Accountants, Directors of Finance and Chief Management of Improvement in the management of the public debt team has been Budget Managers. This includes sensitizing Budget Managers This includes sensitizing Public Debt Records; enhanced via ensuring the timely update of the trainees on the general audit findings and information in the debt management system (DMFAS). the need to implement audit recommendations The Treasury team is also ensuring that the public in their various budget agencies and compliance with policies and procedures. debt records (hard copies) are well maintained for ease of reference. As for insufficient supported expenditures and On-the-job training has been provided as well and the procurement irregularities, are underway being joint support from the Development Partners in handled by Internal auditors/audit committees availing monthly update status on the funds disbursed to projects will be of great importance; & RPPA respectively; 6 7 2

10/25/2010 Implementation of recommendations by the Control/Audits Implementation of recommendations by the Control/Audits Key Remaining Challenges Key Remaining Challenges Key recommendations Actions taken Improvement in the reconciliation the Differences between funds transferred from Ensure the proper roll out of IFMIS as the future budget and Smartgov budget execution system & the OTR and funds received/recorded by Budget accounting system for the Government as a solution to the financial respective Budget Agencies; Agencies has been corrected and presently the status is fully reconciled; reporting weaknesses; Reimbursements Improvement in the Treasury General ledger of balances on travel ; imprest previously treated as income, which Continue addressing other remaining recommendations is presently netted off from the previous p y p progressively; i l payments; Suspense accounts have been addressed Constant follow up to ensure compliance in the implementation of only remaining some errors of commission financial policies and regulations; to be solved progressively; Continuous upgrading and fresh trainings for the existing and new entrants in Finance and Accounts; 8 9 Overall Conclusion Overall Conclusion To sum up all these, MINECOFIN is deeply committed to its responsibility of improving the Public Financial Management System (PFM) and believes also in joint Management System (PFM) and believes also in joint efforts from all the Stakeholders in achieving the set objectives of the PFM reform strategy . 10 3

Recommend

More recommend