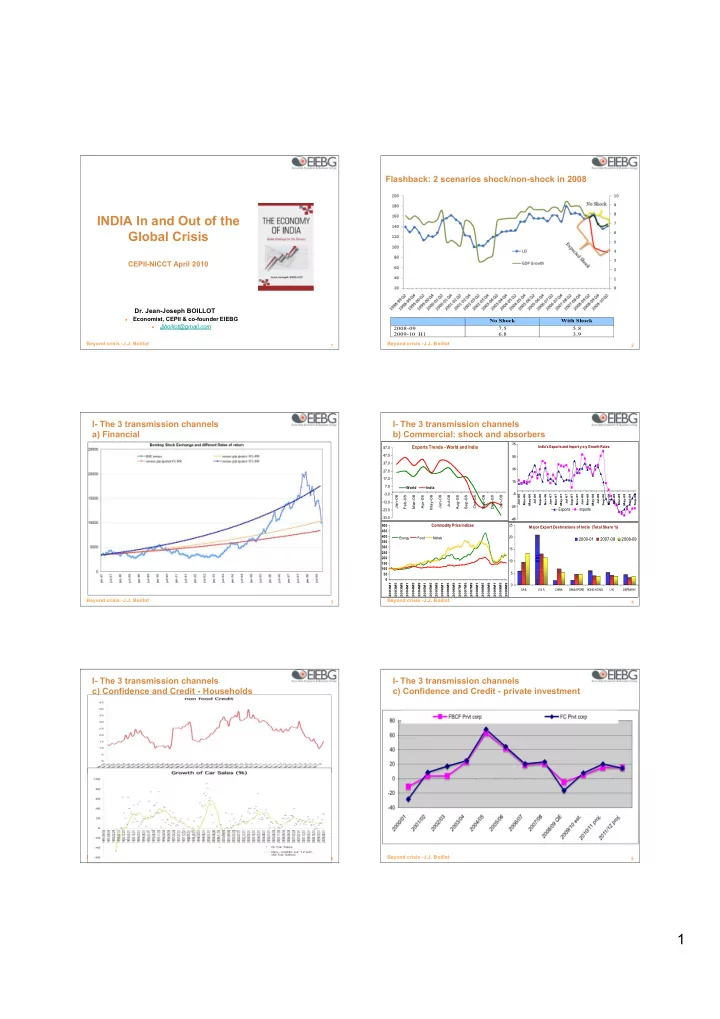

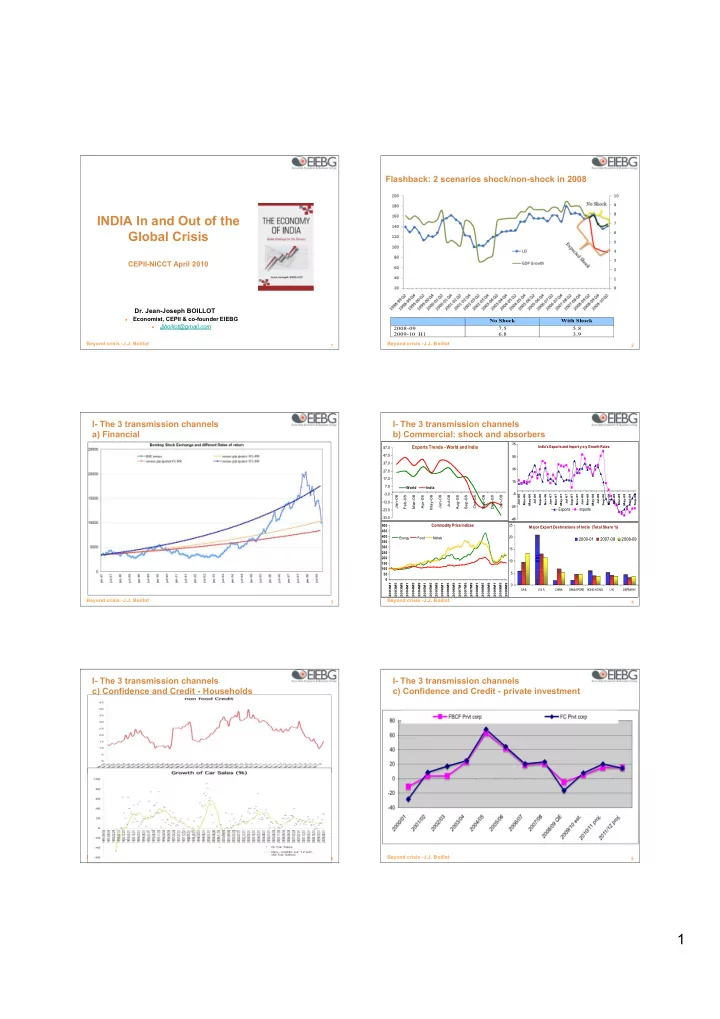

Flashback: 2 scenarios shock/non-shock in 2008 INDIA In and Out of the Global Crisis CEPII-NICCT April 2010 Dr. Jean-Joseph BOILLOT Economist, CEPII & co-founder EIEBG No Shock With Shock Jjboillot@gmail.com 2008-09 7.5 5.8 2009-10 H1 6.8 3.9 Beyond crisis -J.J. Boillot Beyond crisis -J.J. Boillot 1 2 I- The 3 transmission channels I- The 3 transmission channels a) Financial b) Commercial: shock and absorbers 75 Exports Trends - World and India India's Exports and Import y-o-y Growth Rates 57.0 47.0 55 37.0 35 27.0 17.0 15 7.0 World India -3.0 -5 Jan-08 Mar-08 May-08 Jun-08 Jul-08 Nov-08 Jan-09 Jan-06 Mar-06 May-06 Jul-06 Sep-06 Nov-06 Jan-07 Mar-07 May-07 Jul-07 Sep-07 Nov-07 Jan-08 Mar-08 May-08 Jul-08 Sep-08 Nov-08 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Feb-08 Apr-08 Aug-08 Sep-08 Oct-08 Dec-08 -13.0 -25 Exports Imports -23.0 -33.0 -45 500 Commodity Price Indices 25 Major Export Destinations of India (Total Share % ) 450 400 20 Energy Food Metals 2000-01 2007-08 2008-09 350 300 15 250 200 10 150 100 5 50 0 2003M1 2003M5 2003M9 2004M1 2004M5 2004M9 2005M1 2005M5 2005M9 2006M1 2006M5 2006M9 2007M1 2007M5 2007M9 2008M1 2008M5 2008M9 2009M1 2009M5 2009M9 0 UAE U S A CHINA SINGAPORE HONG KONG U K GERMANY Beyond crisis -J.J. Boillot Beyond crisis -J.J. Boillot 3 4 I- The 3 transmission channels I- The 3 transmission channels c) Confidence and Credit - Households c) Confidence and Credit - private investment Beyond crisis -J.J. Boillot Beyond crisis -J.J. Boillot 5 6 1

II- The 3 factors of resistance: The « Good Crisis »! a) Sound financial structures and monetary prudence 45 CREDIT CREDIT QUARTERLY QUARTERLY 40 35 30 25 20 15 10 5 0 sept-97 sept-98 sept-99 sept-00 sept-01 sept-02 sept-03 sept-04 sept-05 sept-06 sept-07 sept-08 sept-09 janv-98 mai-98 janv-99 mai-99 janv-00 mai-00 janv-01 mai-01 janv-02 mai-02 janv-03 mai-03 janv-04 mai-04 janv-05 mai-05 janv-06 mai-06 janv-07 mai-07 janv-08 mai-08 janv-09 mai-09 Beyond crisis -J.J. Boillot Beyond crisis -J.J. Boillot 7 8 II- The 3 factors of resistance: II- The 3 factors of resistance: b) Productive structure: i) a strong Services sector b) Productive structure: ii) the consumption driver FBCF totale C Pvte C totale Inv Ext Conso priv Conso Pub 70 20 60 15 50 40 10 30 5 20 10 0 0 -10 -5 2000/01 2001/02 2002/03 2003/04 2004/05 2005/06 2006/07 2007/08 2008/09 2009/10e 2010/11p 2011/12p 2000/01 2001/02 2002/03 2003/04 2004/05 2005/06 2006/07 2007/08 2008/09 2009/10e 2010/11p 2011/12p Beyond crisis -J.J. Boillot Beyond crisis -J.J. Boillot 9 10 II- The 3 factors of resistance: II- The 3 factors of resistance: c) Economic Policy: i) Budgetary policy ii) Monetary policy and quick confidence return FBCF totale C Gov FBCF Prvt corp FW6mois call rate 91j 10ans BSE SENSEX FII USD million) 20 25000 6000 70 23000 18 60 4000 16 21000 50 19000 14 2000 40 12 17000 30 10 15000 0 13000 20 8 -2000 6 11000 10 9000 4 0 -4000 7000 2 -10 5000 -6000 0 -20 déc-01 déc-02 déc-03 déc-04 déc-05 déc-06 déc-07 déc-08 déc-09 2000/01 2001/02 2002/03 2003/04 2004/05 2005/06 2006/07 2007/08 2008/09 2009/10e 2010/11p 2011/12p Beyond crisis -J.J. Boillot Beyond crisis -J.J. Boillot 11 12 2

III- Outlook 2010 iii) And Flexibility of the Monetary policy a) Uncertainty factors i) the inflationary pressures Bank Sources of Funds Rs Mds 3500 Increase in Credit to Commercial Sector 3000 Increase in bank holding of Govt securities * 2500 Capital Market- all Sources 2000 Debt (bonds) $ Capital Market Equity 1500 Raising (a+b+c) IPO and FPO (public) 1000 QIP ** 500 Rights 0 apr– Jan 2008/09 apr– Jan 2009/10 Beyond crisis -J.J. Boillot Beyond crisis -J.J. Boillot **Qualified Institutional Programme 13 14 III- Outlook 2010 III- Outlook 2010 a) Uncertainty factors ii) Agriculture production a) Uncertainty factors iii) Real income and demand Unit: per cent Q1 Q2 Q3 Q4 apr-Jun July-Sep Oct-dec jan-10 all Products 0,5 -0,1 4,5 Primary Goods 6,5 7,9 11,8 Primary Food 9,3 13,9 16,3 Foodgrain 13,5 14,6 16 Energy -8,2 -9,3 -1,3 Manufactured Goods 1,5 0,2 3,6 Manufactured Foods 12,6 11,4 22,8 Special combinations Manufactured goods Excl Foods -1 -2,3 -0,6 Manufactured Foods Excl Sugar 6 1,9 12,4 Primary & Manufactured Food Items Wheat 6,6 3,7 12,2 14,8 Rice 16,2 18,2 13,3 12 Coarse cereals 16,7 19,5 17,5 17 Pulses 16,3 21,1 35 45,7 Fruit & Vegetables 10,3 12,7 13,3 8,4 Sugar gur & khandsari 31,6 38,3 48,9 Dairy products 3,8 5,8 11,3 Beyond crisis -J.J. Boillot Beyond crisis -J.J. Boillot 15 16 III- Outlook 2010 III- Outlook 2010 a) Uncertainty factors iv) the budgetary soft-landing but do not overestimate the Public debt constraint Beyond crisis -J.J. Boillot Beyond crisis -J.J. Boillot 17 18 3

III- Outlook 2010 III- Outlook 2010 b) Because the Potential trend is on the upside with a specific Indian pattern in comparison with China Post-Reform GDP Grow th Rates: China Vs India (t=1978 for China and 1991-92 for India) 16 y = 0,0076x + 9,7081 14 R 2 = 0,0008 12 10 8 % 6 y = 0,2011x + 4,484 R 2 = 0,365 4 2 China India Linéaire (India) Linéaire (China ) 0 t t+2 t+4 t+6 t+8 t+10 t+12 t+14 t+16 t+18 t+20 t+22 t+24 t+26 t+28 Beyond crisis -J.J. Boillot Beyond crisis -J.J. Boillot 19 20 III- Outlook 2010 IV- Winning India b) Sustainability and Attractivity as high as China a) a realistic estimate of the market potential Share in the World GDP at current exchange rate Table 5 Balance of Payments 2004-2010 35% USD 2004/05 2005/06 2006/07 2007/08 2008/09 2009/10 Total 2005 2025 Merchandise Exports 85,2 105,2 128,9 166,2 189 168,7 30% Merchandise Imports 118,9 157,1 190,7 257,6 307,7 296,8 Merchandise Trade -33,7 -51,9 -61,8 -91,5 -118,7 -128,1 Balance -4,70% -6,20% -6,50% -7,40% -9,70% -9,80% 25% Net Invisibles 31,2 42 52,2 75,7 89,9 98,6 o/w Software & BPO 14,7 23,8 27,7 37,2 44,5 47,2 Private Remittances 20,5 24,5 29,8 41,7 44,6 55,7 20% Investment Income -4,1 -4,1 -6,8 -4,4 -4 -4,1 Current account Balance -2,5 -9,9 -9,6 -15,74 -28,7 -29,5 15% % GDP -0,30% -1,20% -1,00% -1,30% -2,40% -2,20% Foreign Investment 13 15,5 14,8 45 3,5 47,3 o/w FDI (net) 3,7 3 7,7 15,4 17,5 20,1 10% Inbound FDI 6 8,9 22,7 34,2 35 36 Outbound FDI 2,3 5,9 15 18,8 17,5 15,8 Portfolio capital 9,3 12,5 7,1 29,6 -14 27,2 5% Loans 10,9 7,9 24,5 41,9 4,1 7,2 Banking capital 3,9 1,4 1,9 11,8 -3,2 4,9 Other capital 0,7 1,2 4,2 9,5 4,5 -10,8 0% Capital account Balance 28 25,5 45,2 108 8,7 48,5 USA China Japan Germany India India* France Brazil % GDP 3,90% 3,00% 4,80% 8,80% 0,70% 3,70% Errors & Omissions 0,6 -0,5 1 1,2 1,1 -1,4 accretion to Reserves 26,2 15,1 36,6 92,2 -18,9 17,6 * 2nd scenario India GS value + CEPII exchange rate valorisation % GDP 3,60% 1,80% 3,90% 7,50% -1,50% 1,30% Forex rate (Rs per US$) 44,9 44,3 45,3 45,6 45,6 47,1 Beyond crisis -J.J. Boillot Beyond crisis -J.J. Boillot 21 22 * fiscal years; source: Review of the Economy 2009/10, EAC, New Delhi, February 2010 IV- Winning India b) a well-targeted sectoral IV- Winning India approach: Transport/Energy/Food/Environment… c) NO MISTAKE, the true challenge is the Human capital Beyond crisis -J.J. Boillot Beyond crisis -J.J. Boillot 23 24 4

Recommend

More recommend